Hello Traders,

We will be explaining the different variations and impacts ahead of this Friday’s Non-Farm Payrolls due at 13:30 GMT time, so that traders can stay informed about the various possibilities. For those who might not know the NFP releases every month on the first Friday of a new month at 13:30 GMT.

Firstly, as we have seen over the last 4 years the markets were more sensitive towards CPI (inflation) data, however things appear to start shifting especially from last month.

Following the words from US Federal Reserve chairman, Jerome Powell hinting that inflation has come under control and it’s on its way down closer to the 2% region which is the desired area to be at now the markets will be mostly sensitive from jobs related data.

During the previous NFP release last month on August the 2nd 2024 we have seen a significant decrease in new jobs down to 114k vs the 176k which was the forecast. Additionally, we have seen a significant rise in unemployment to 4.3% vs the 4.1% forecast while back in April it was at 3.8%. This has created dear across the markets under a unique dynamic.

As many might recall the markets reacted quite strongly last month following up the increase of unemployment and much lower jobs created a number which we haven’t seen since the end of 2021.

According to investing.com here are the numbers mentioned above:

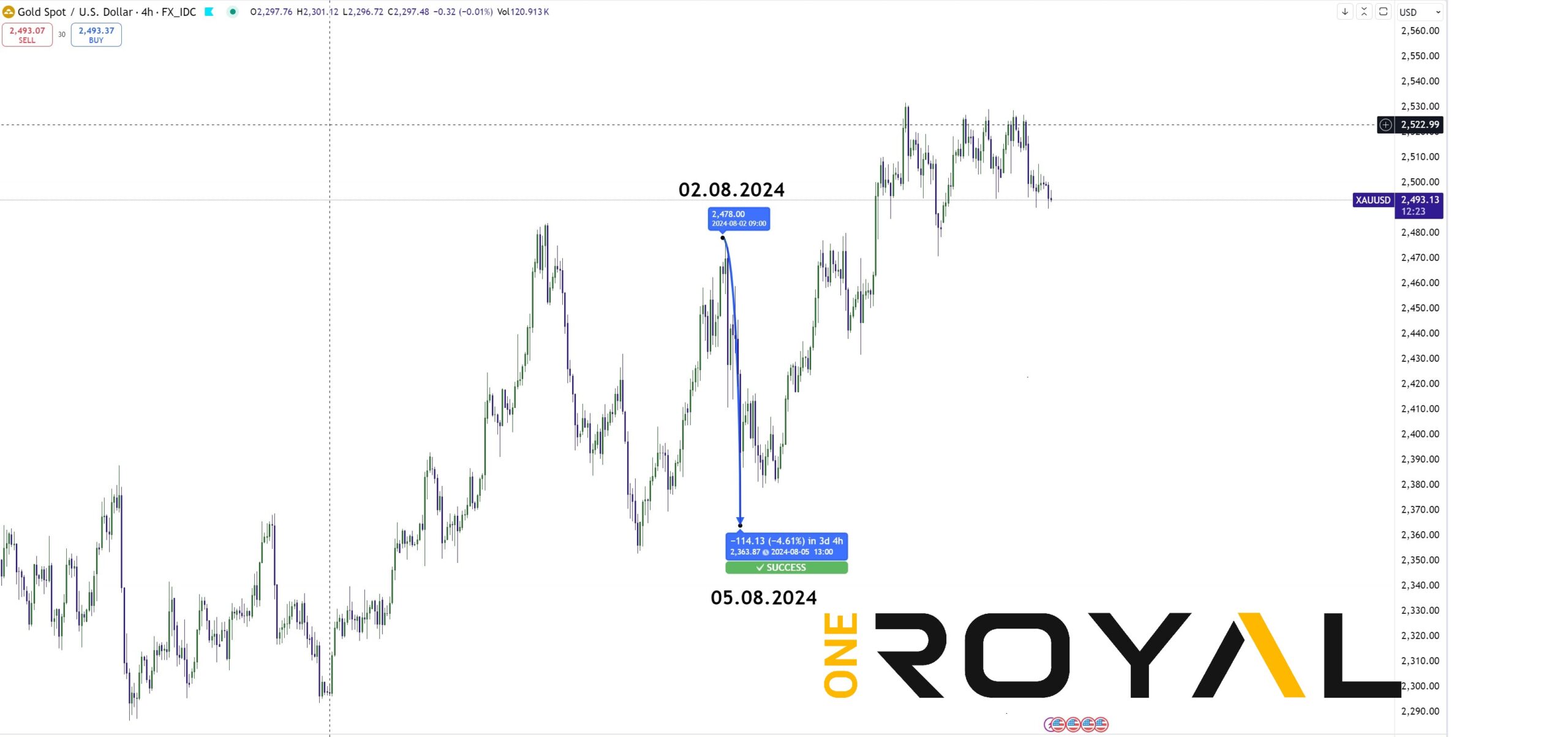

We will be showcasing certain key instrument’s charts below to indicate the impact of the above results as the markets have reacted in fear of an upcoming recession during last month’s release.

USDX (US Dollar Index) known as DXY – Dropped by 2.18% within 2 trading days

EURUSD – Moved higher by 2.11% within 2 trading days

XAUUSD – Gold Dropped by 4.16% in 2 trading days

ES 500 (S&P 500 E-MINI FUTURES) Dropped by 8.48% within 3 trading days

The above market reactions were caused by the previous month’s NFP across the US Dollar, Gold & to a major equities Index such as the S&P 500. It is important for traders understand that markets can be very sensitive to any increase or decrease in unemployment % as well as the actual non-farm payroll data as of late due to rising fears of a US recession. Positive outcomes can have the opposite effects and we will be providing the different variation of outcomes in our next article so you can be informed ahead of tomorrow’s release.

If you are new here and you do not have a trading account with us, you can create one at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.