Hello Traders,

Good afternoon to all and here we are post NFP into the New York session and let’s have a look at the market reactions and relate to the NFP outcome as we have provided this morning with a pre release market outlook at: Market Outlook Before NFP Release 06.09.2024 – What Traders Need To Know – OneRoyal Blog

The NFP outcome was mixed overall. Despite the payrolls a little lower than expected they were higher from the previous month while unemployment was slightly lower from last month and on point with the forecast, and the average hourly earning has seen an increase from the previous and slightly higher from the forecast.

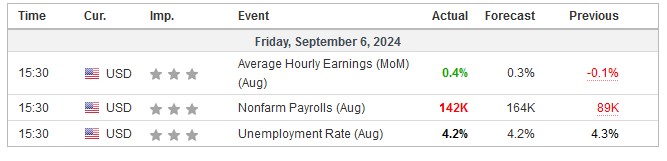

Data provided by investing.com

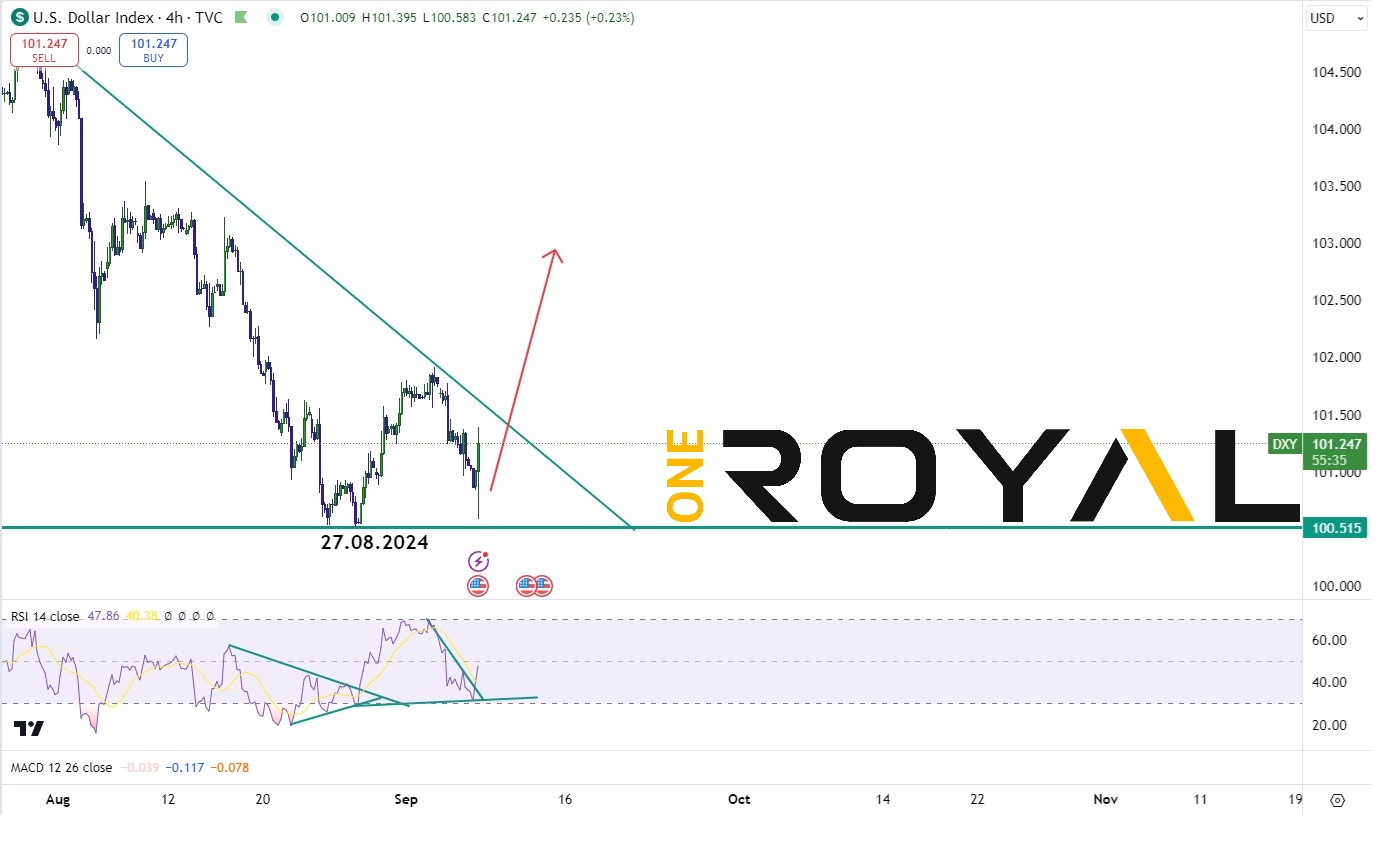

Overall the market took the above outcome as a relief from previous month’s worries about a serious upcoming recession and thus after a quick spike lower the USDX has turned up afterwards. As we have explained this morning the different possibilities we have highlighted the important of the pivot from 27.08.2024 in the US Dollar Index in which as far as it hold a double correction higher is on track to correct at least the cycle from 26.06.2024. At this stage entering into the next week it will be interesting to observe whether it will manage to break the trendline and generate a move higher towards the 103 area. Important to note the CPI data coming up on Wednesday 11.09.2024. We will be providing on Monday morning the next week’s market outlook. It’s important to highlight that the way the market will end the day could be crucial to what happens next week.

Let’s now provide with the relevant charts following this morning’s post. The forecasts and analysis below are based on current technical data and provided purely for educational purposes.

USDX 4 HR – Looking for the potential breakout move heading into next week as far as momentum continues to the upside as far as 27.08.2024 pivot stays intact and momentum continues

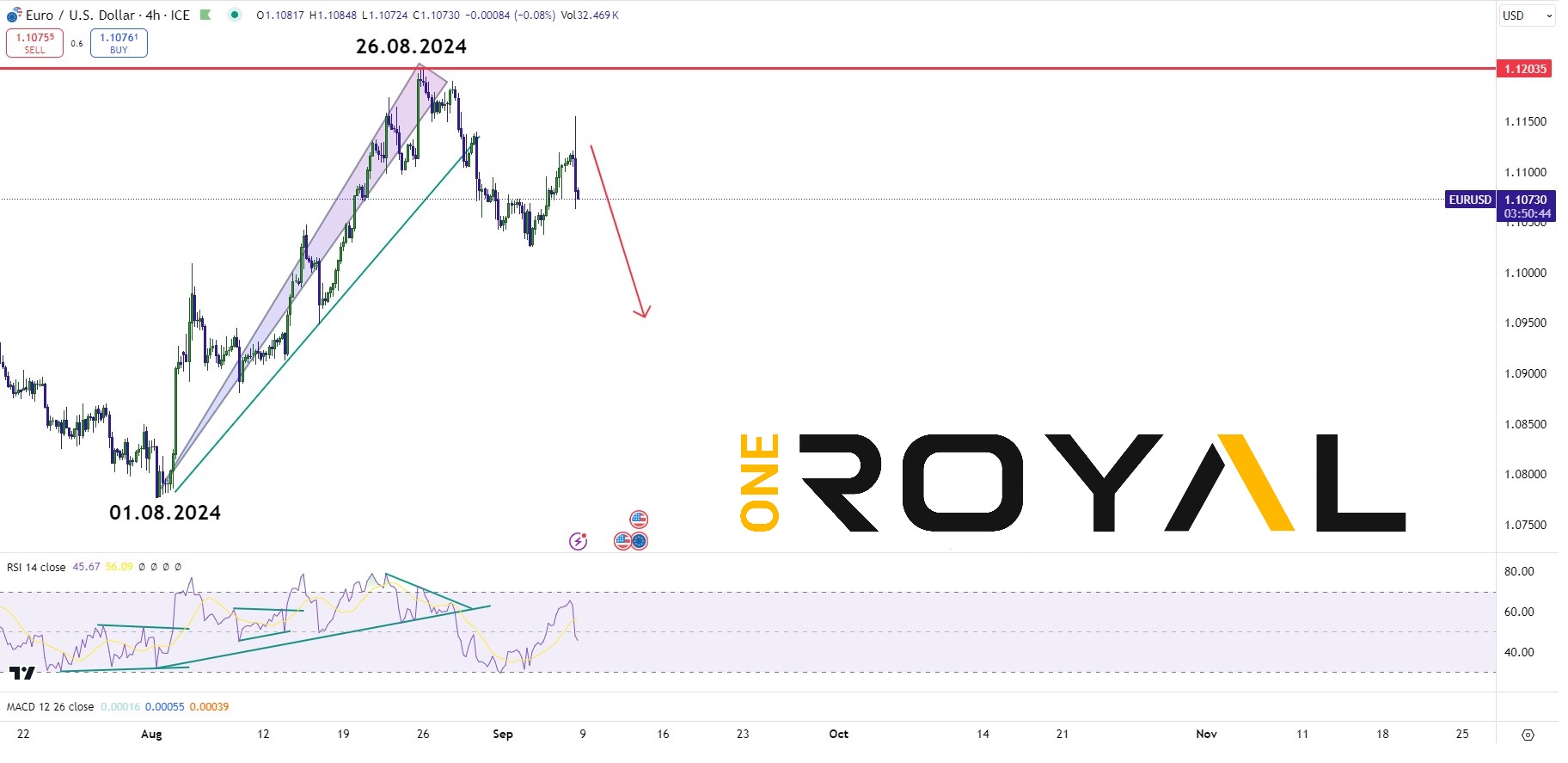

EURUSD 4HR – Mixed but looking for the potential move lower for a double correction from 26.08.2024 peak. Otherwise sideways short term

XAUUSD – 4HR Still neutral however if the USDX break higher it will be looking for potentially the double correction lower as far as 20.08.2024 peak remains intact

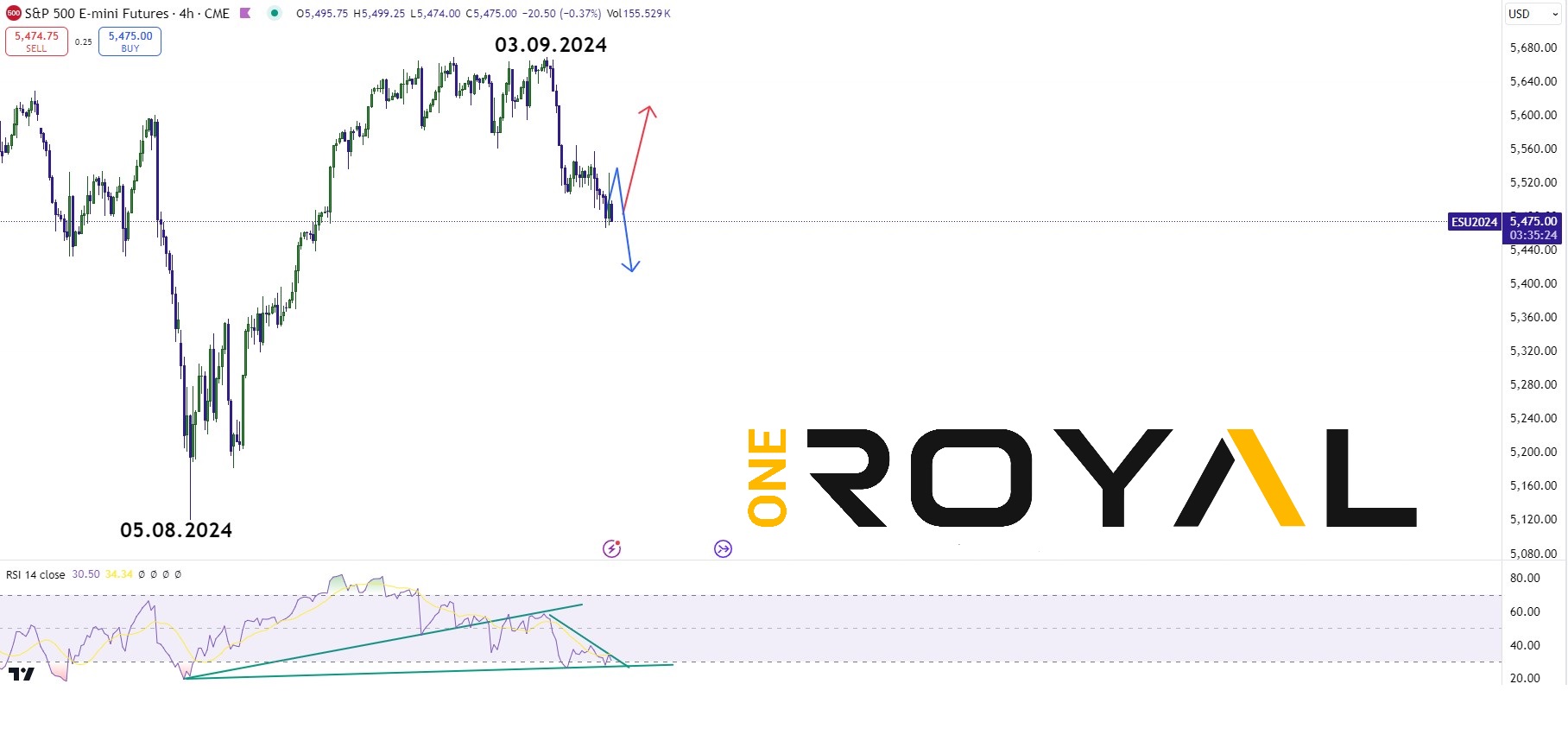

ES500 Mini Futures 4HR – Still Mixed & Undecisive – Tilted to the downside for now – Cycle from 03.09.2024 as a correction lower remain intact

Those where the updates post NFP release for today. As we have explained it’s important to see how the day closes heading into the following week. Stay tuned for Monday’s weekly market outlook. Enjoy your weekend ahead. If you are new here and you are not yet trading with us you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.