Hello Traders,

Heading into the second week of the month after the US NFP and unemployment data, we have seen nonfarm payrolls coming positive at 254K vs the 147K, expectations while unemployment rate came down to 4.1% from 4.2% in an overall positive outlook for the US jobs market and a recovery bounce in the US Dollar after the last 2 months decline. This week the focus is shifting towards FOMC minutes, CPI and PPI data. Furthermore, New Zealand’s Interest rate decision and UK’s GDP is ahead of us.

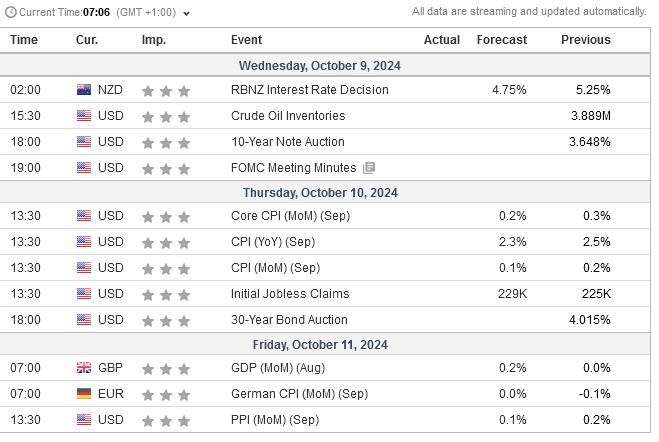

The Calendar – Important Economic Releases – London Times (source: investing.com)

First important release is from New Zealand’s Interest Rate Decision which is expected to have a rate cut from 5.25% down to 4.75% at least, following up with ECB & US federal Reserve’s footprints, while the same day FOMC minutes will take place as traders would seek for more clues for the future of US monetary policy. The next Day’s CPI is expected to come down to 2.3% vs the 2.5% previously, while any rise of it would cause some short term volatility. The week ends with UKs GDP and US PPI.

Markets Technical Outlook

USDX 4HR – Key Week To Decide If It Should Head Towards Upper 103 Levels, Possible Consolidation – RSI Suggests Currently In Strength

EURUSD 4hr – 1.0900 Area Reached – Short Term Weakness Might Continue Within The Lower End Of The Area

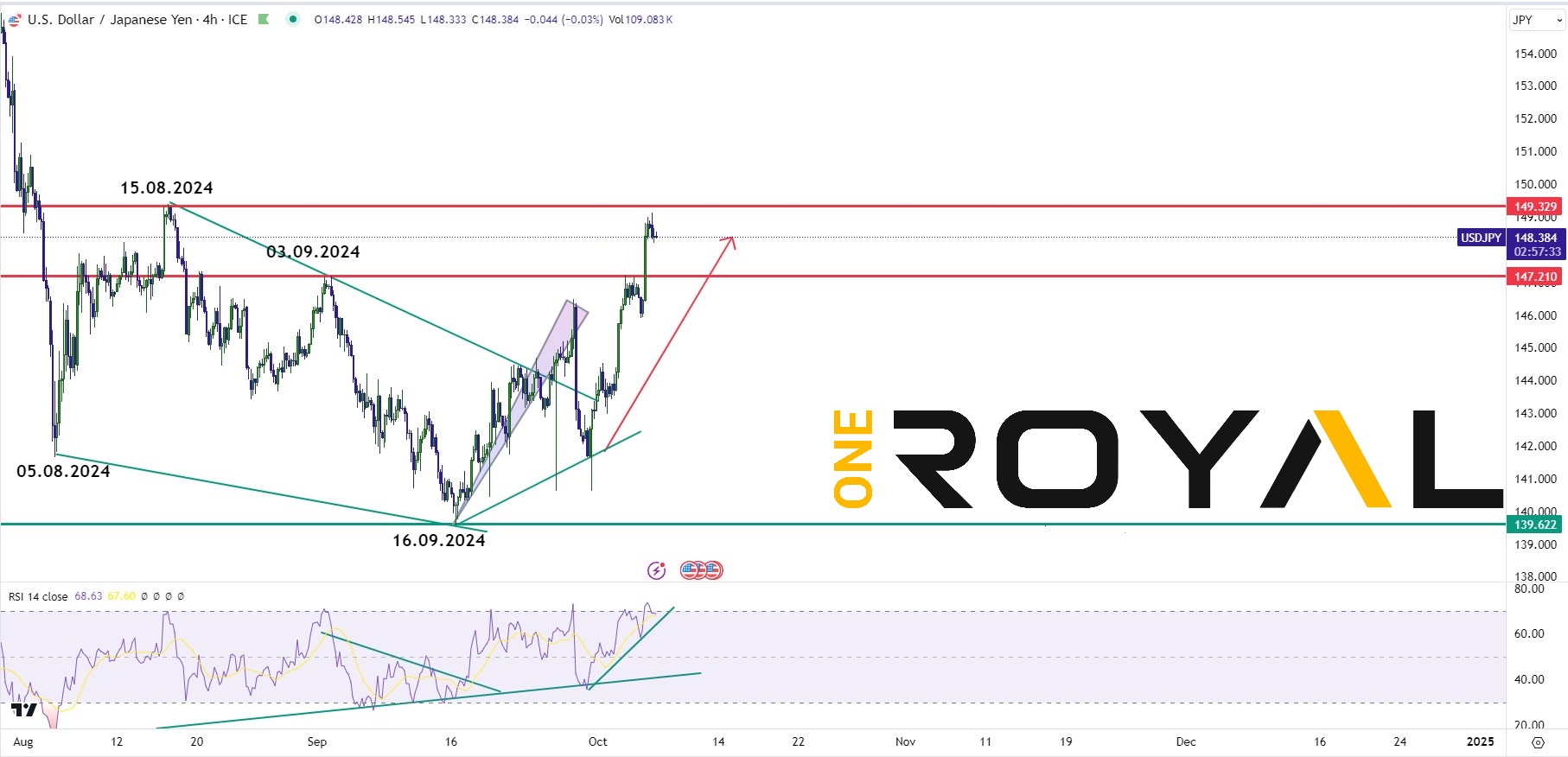

USDJPY 4HR – Reached The 148 Area, Currently Buyers In Control – Reaction To Determine What Happens Next

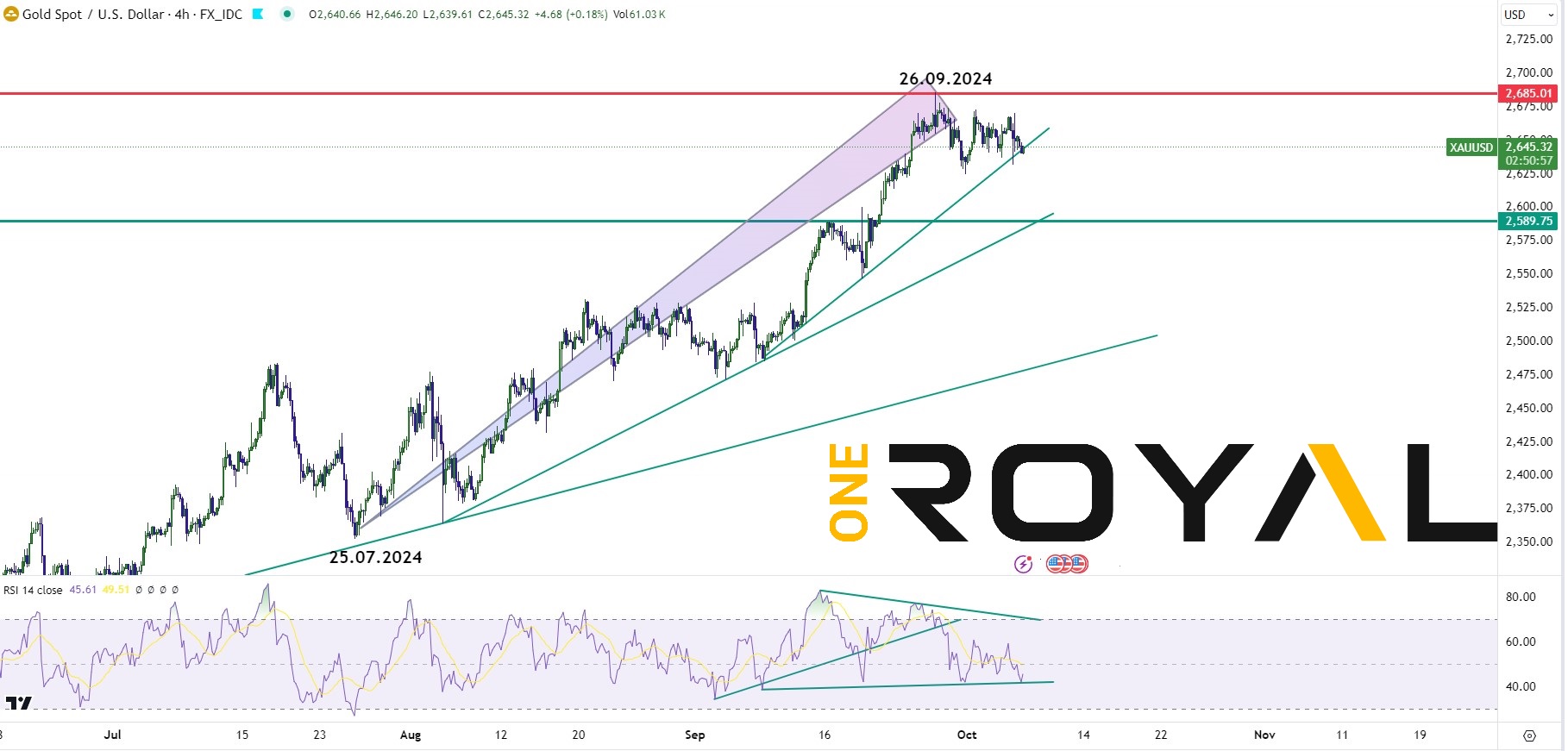

XAUUSD 4HR – Buyers Still In Control – Key Week To Decide If 26.09.2024 Break or If It Will Still Consolidate Sideways To Lower

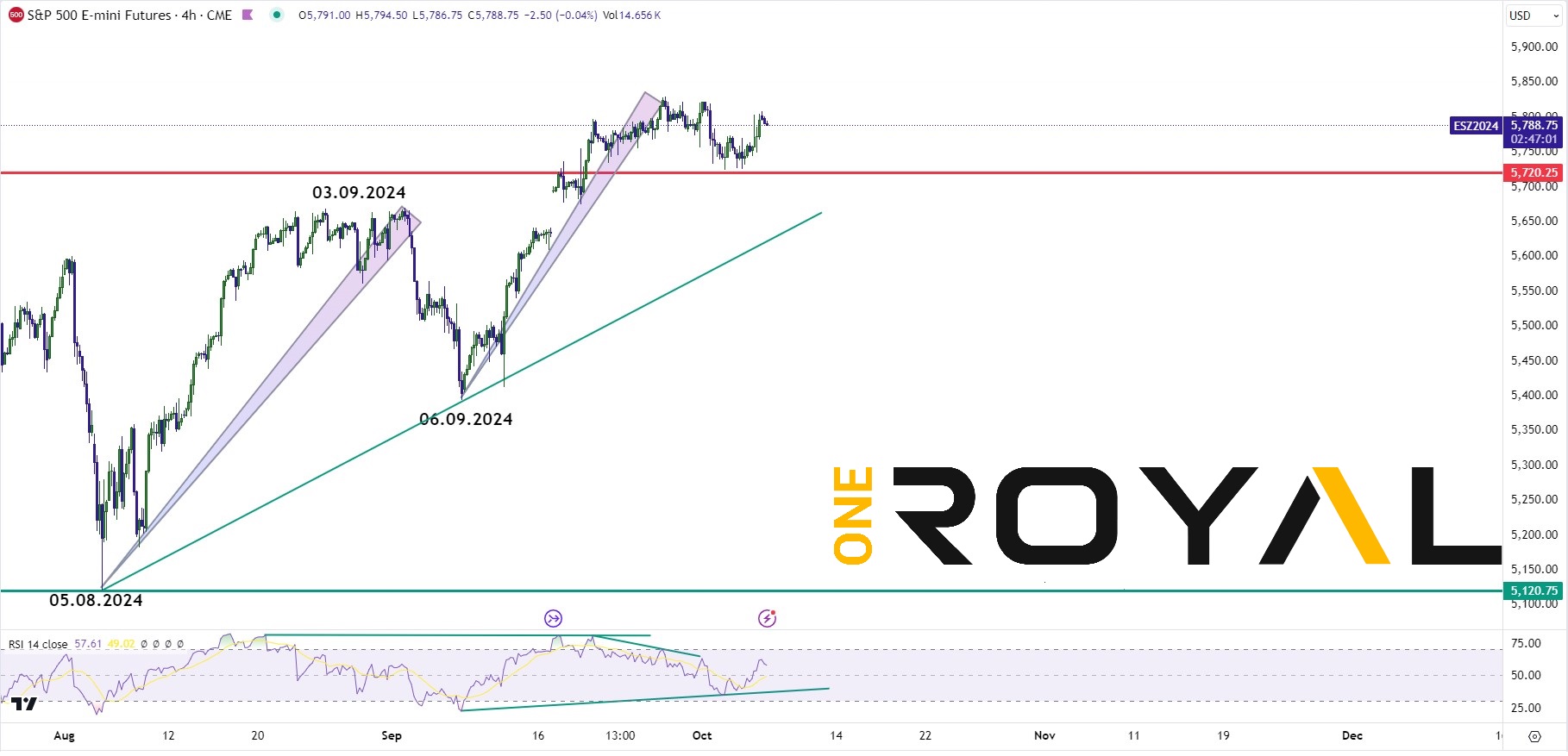

ES500 Mini Futures 4HR – Buyers Still In Control – Cycle from 06.09.2024 Still Intact – CPI Might Be Key This Week

The markets overall should be anticipating the CPI data this week for the next potential move as any signs or increase in inflation can cause volatility and more spikes higher in the US Dollar while anything within expectations could continue to provide support for equities, gold and put downwards pressure for the US Dollar. More updates during week.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.