Hello Traders,

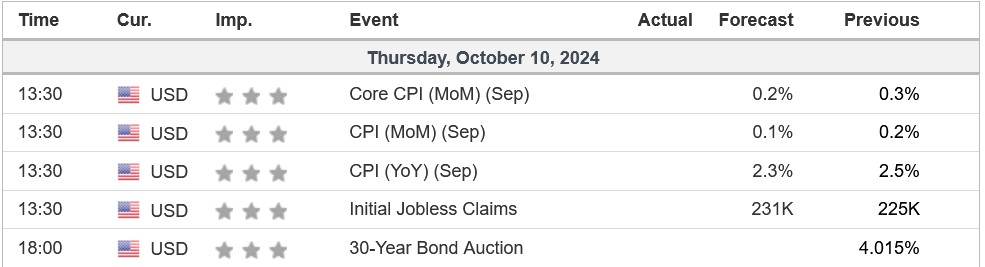

As we are a couple of hours before the US CPI release today, let’s see what is the market’s technical outlook as well as the expectations for the CPI according to the forecasts from analysts. According to analysts CPI (YoY) (Sep) is expected to come at 2.3% which is 0.2% lower vs the previous month’s release, while Core CPI also is expected by 0.1% lower at 0.2% vs 0.3% from the month prior. CPI (MoM) as well expected to come in 0.1% lower.

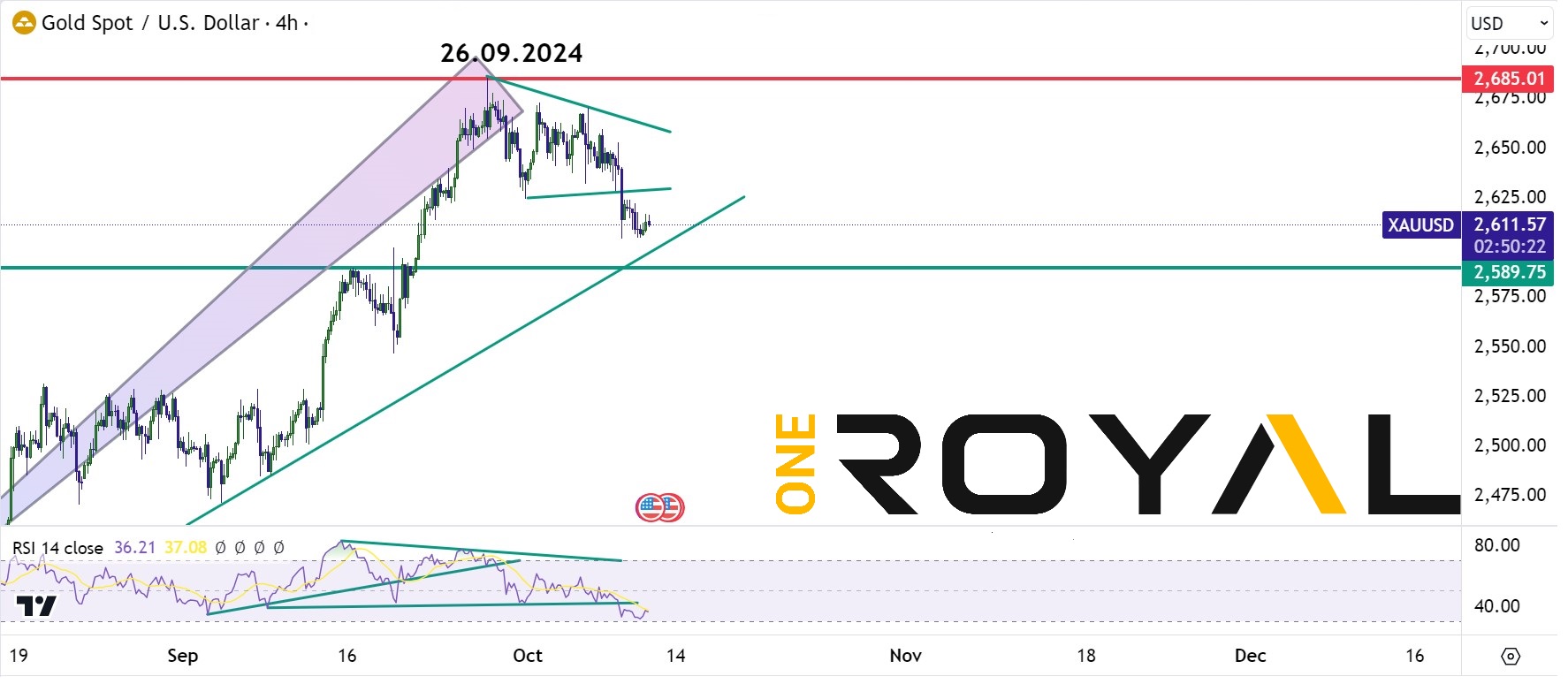

In case which these CPI figures come up as the forecast or at least if majority of them do or slightly lower then this could impose weakness in term of the US Dollar and the opposite effects in case we have a surprise and inflation number come in higher from these forecasts.

Today’s releases in detail:

Data Provided by investing.com – Time Zone – London

Additionally, Jobless Claims are due at the same time as forecasts indicate a potential increase which consequently might also entail weakness for the US Dollar if this would be the case.

USD Related Technical Market Outlook:

USDX 4 HR – Around Key Resistance Area – RSI Divergence Thus Far – CPI To Be Key For The Next Reaction

USDJPY 4HR – RSI Showing Divergence Thus Far – Around Key Resistance From 15.08.2024 Peak

XAUUSD 4HR – Broke Lower Near Potential Support Area

This is what we have ahead of the US CPI release as the market is anticipating it for the next reaction to take place. Traders should be aware of the various potential outcomes mentioned above as it is expected to impact all USD related instruments today.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.