Hello Traders,

As Q3 earnings reports have been announced over the past 2-3 weeks, Amazon has reported it’s 7th positive report in a row since 2023. In this article we are going to analyze it’s shares market cycle from 2023 as is it already trading within all time highs and whether it could trade once again to new all time highs above the $200 area. Regarding the earnings in Q3 of this year, the company announced earnings per share of 1.43 against the estimate of 1.14 & a revenue of 158.877B against the estimate of 157.275B.

Amazon Q3 2024 Earnings & Revenue source (tradingview)

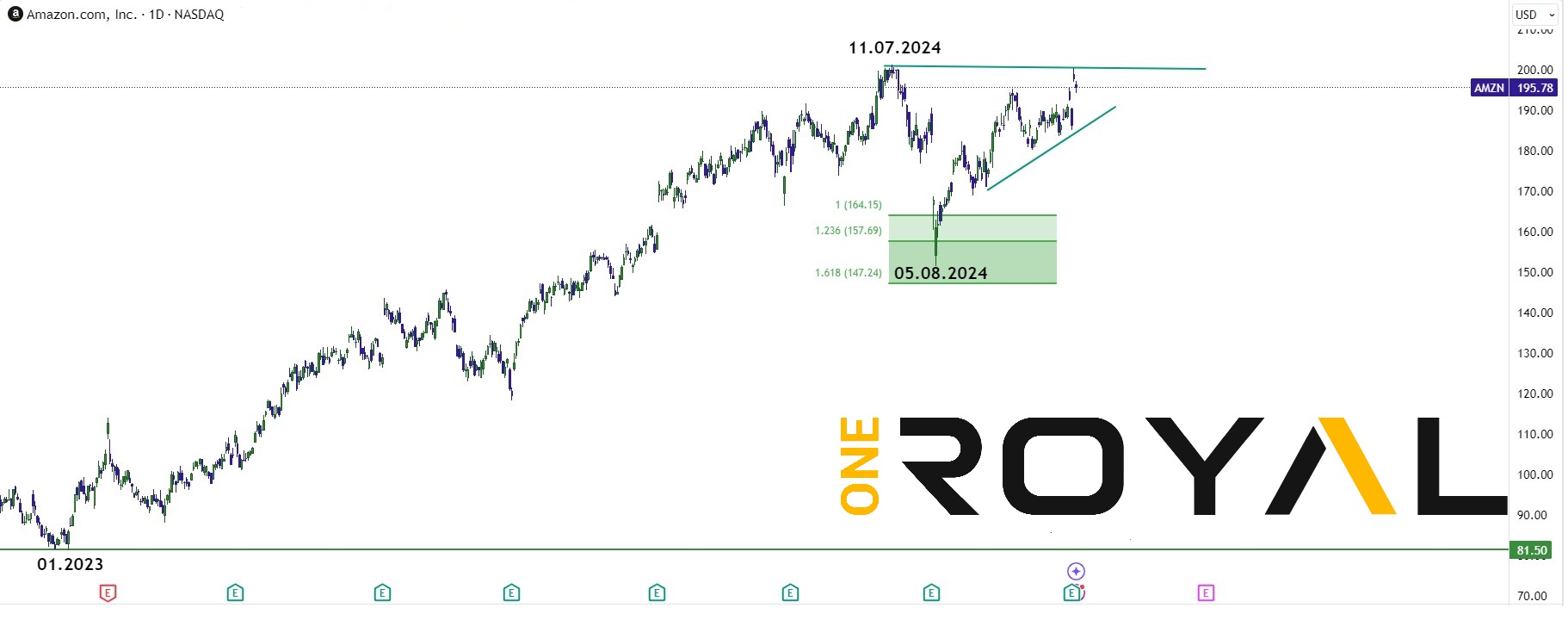

Regarding the market’s technical outlook , the shares has been in a bullish cycle since the start of 2023 after 2022 corrective cycle lower, the market made a pivot low at the $81.50 area in January 2023. The recent peak on July 11th 2024 produced a bigger reaction lower in which appears so far to have been a clear 3 swings pullback and found support from the trend based Fibonacci extension area ($164.15 – $147.24) with a current low from 05.08.2024.

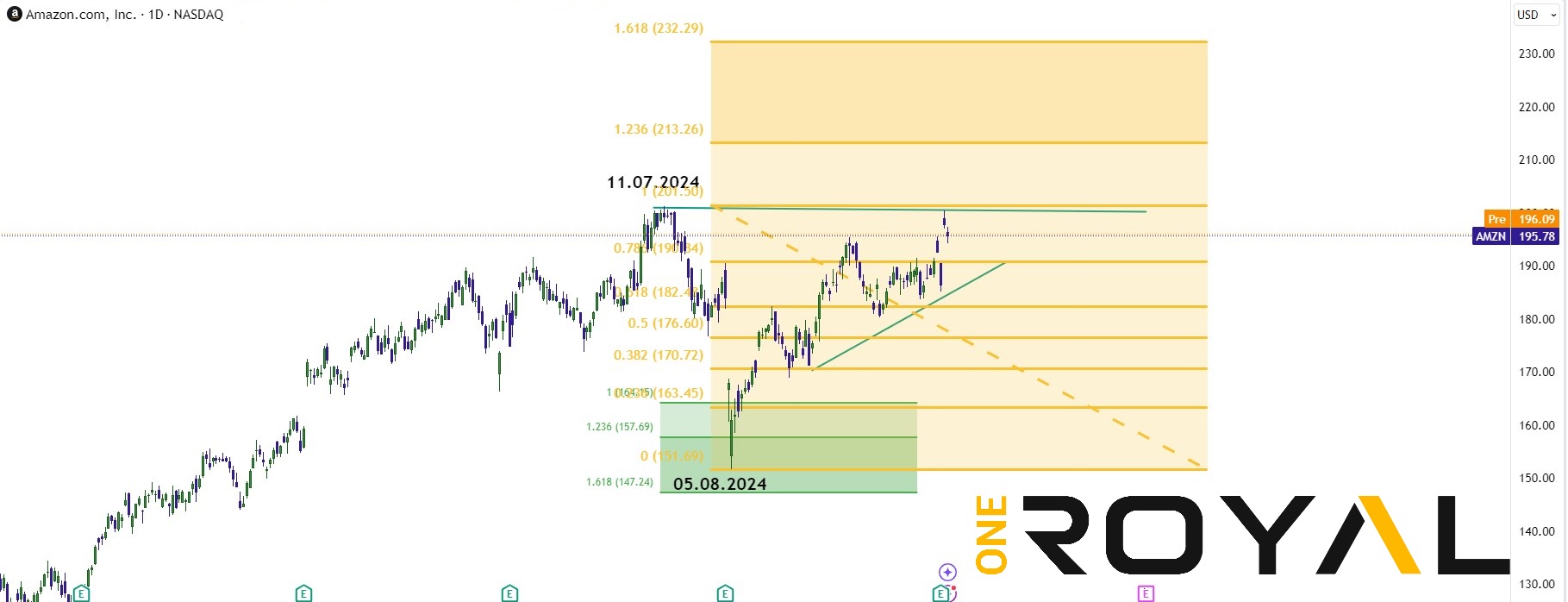

Thus far the market has not been able to trade above July 11th’s peak, with a reaction higher from the earnings report last week on 31.10.2024. The current price action suggests that the market remains bullish overall and as far as the shares are trading above $150 and August’s low the momentum should support the idea of a breakout to new all time highs. Otherwise, a break of August’s pivot might entail a double correction for the cycle from 2023 into July’s 2024 peak.

The first potential targets to the upside if the shares manage to break the $200 area should the the $213.26 – $232.29 area which are the 1.236 – 1.618 inverse Fibonacci retracement levels from the previous pullback from this summer. These targets should be the shorter term targets that might be reached during Q4 2024. It should be key as well the upcoming potential rate cut from the US Federal reserve on Thursday 7th of November in which should determine the size of it whether it should be a 25bps rate cut or bigger as we saw during 18th of September. And moreover, the last FOMC meeting for the year December the 18th should also play a key role in the future trend of the Amazon shares. As far as the sentiment remains optimistic about these rate cuts and they are taking place without any significant rises in unemployment and the overall US economy remains in healthy levels the probabilities of Amazon trading to new all time highs are higher.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.