Hello Traders,

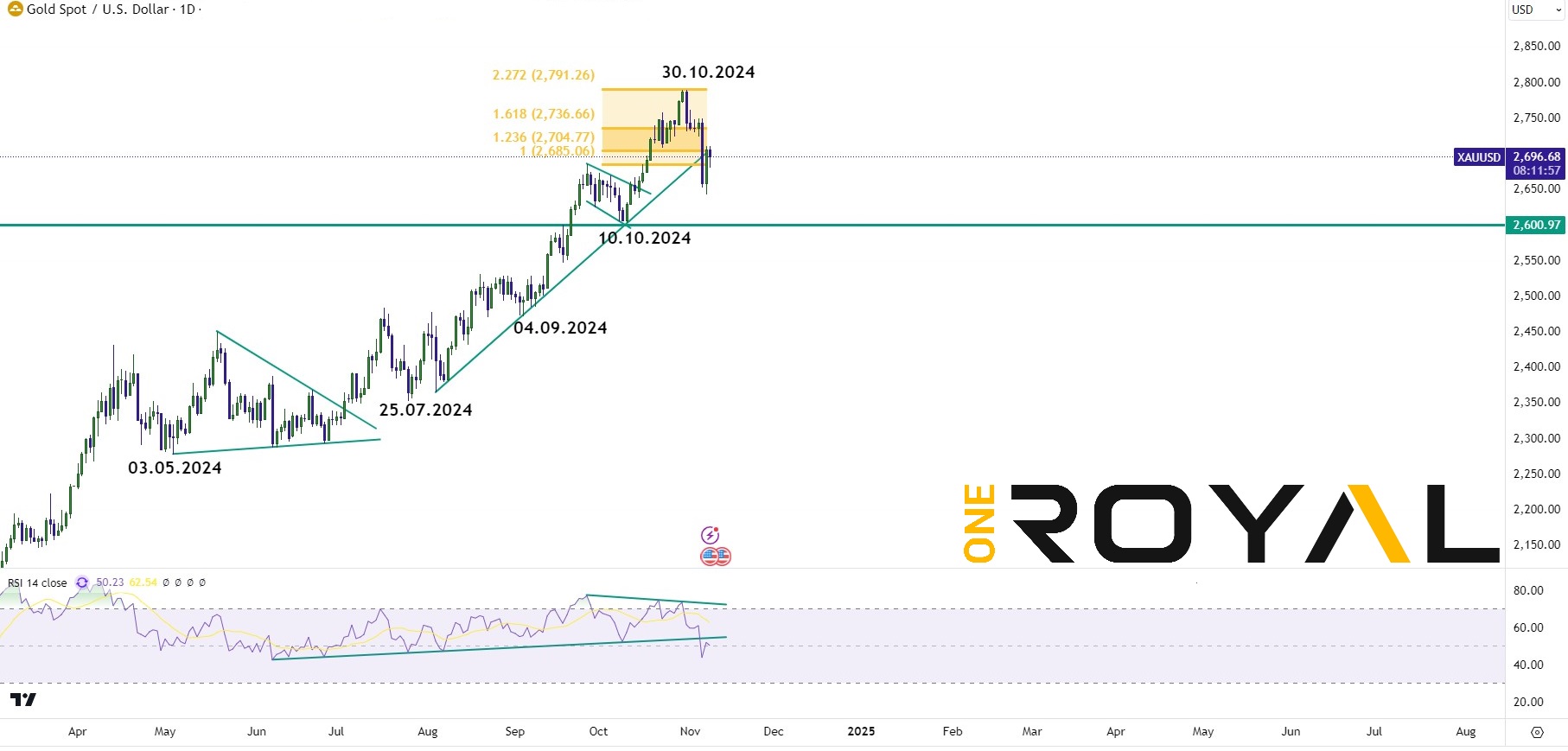

As the US Elections were ending earlier this week, gold has reacted lower as the political uncertainty came to an end after the results were getting clear, as well as profit taking after the metal has reached a technical target level of $2791.26. Gold has surged tremendously over the course of this year with a 38% move from the area of the $2000 to the $2791.26 as middle east tensions and wars have been the main headlines alongside with the political uncertainly before the US Elections.

Looking at the technical outlook we can see that the pullback from 30.10.2024 to the $2643 area was also a technical move as the market has reached the above mentioned target level. The pullback might have been a short term buy the dip scenario or it could be a sign of potential short term weakness and that the cycle from the beginning of the summer might have ended.

XAUUSD 8H Technical Outlook

The RSI suggests that the cycle from the summer might have ended as none of the RSI trendlines hold. From the other hand if it does not break below $2600 and 10.10.2024 low then one more high might take place. Given the length of time with combination with the RSI weakness, calming of the political uncertainty in the US the probabilities of seeing Gold doing a double correction lower are increasing.

In the daily time frame, as far as the peak from 30.10.2024 remains intact and bounce might fail for one more move at least to the downside whereby a retest from the summer highs around the $2480 – $2500 won’t be out of question. Yesterday’s FOMC and the 0.25% bps rate cut didn’t do much for the metal as that was anyway the market’s expectation from before and thus the market has been pricing it in already. The RSI breaks below the main trendline that Gold has established throughout the trend from June 2024 and might expose greater risks to the downside vs any potential rewards to the upside at this stage.

Buyers should be cautious as risk to reward at this extended stage and signs of weakness might not provide the best environment for a bullish near term outlook, as well as the possibility of a sideways to lower dynamic.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.