Hello Traders,

Good morning to all, and we are finally a couple of hours before the NFP release today at 13:30 GMT and let’s have a look at certain key major instruments and their current dynamic before the release so that we can analyze certain scenarios and understand the possibilities ahead. Traders need to take into consideration both sides and that will depend on the outcome of the NFP Release. Traders need to be aware that a mixed release could also create a sideways market in the short term. Learn the different variations of the release at our blog: https://blog.royal-fi.com/blog/preparation-ahead-of-fridays-06-09-2024-nfp-release-part-2-various-outcomes/

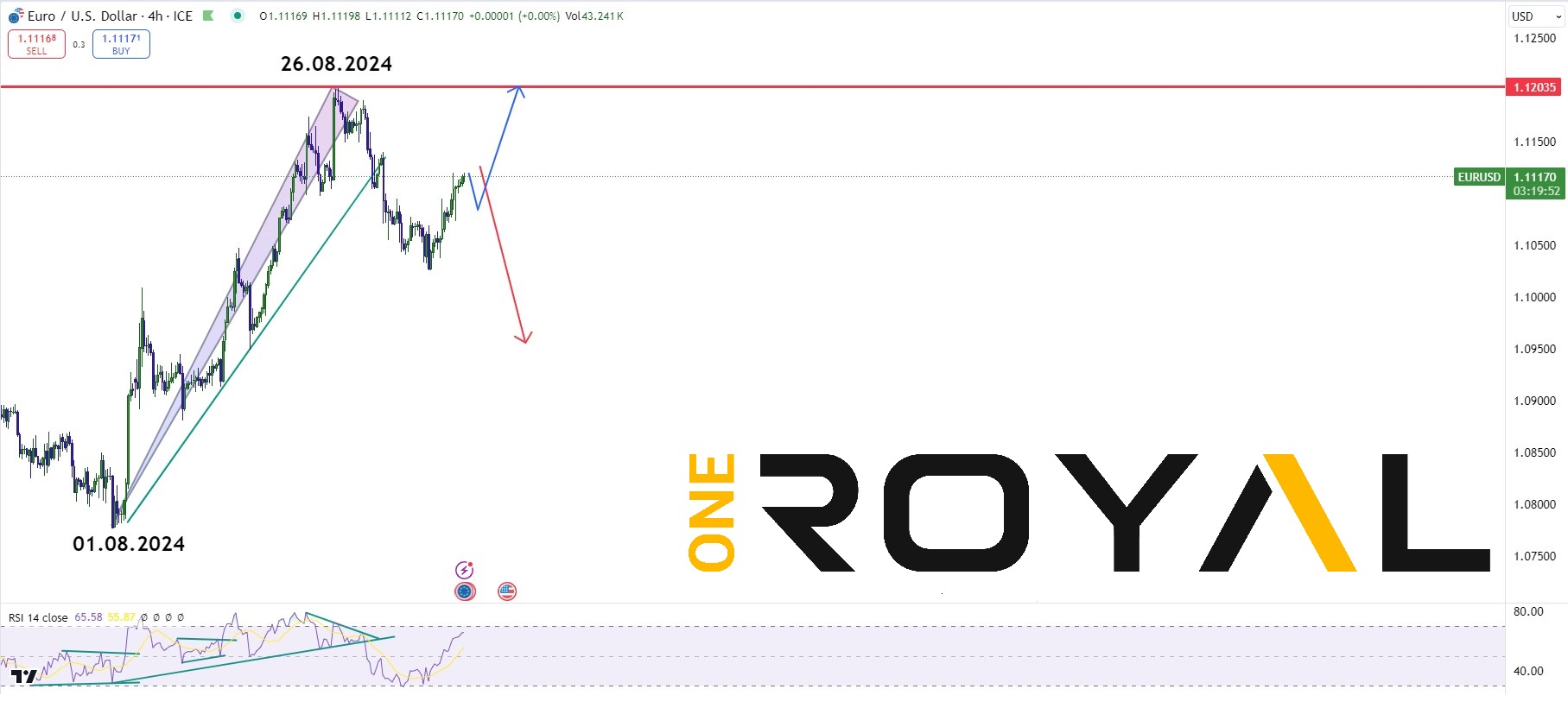

Important to note for the technical charts we will present below that we present in red the most probable path according to the current technical data and in blue we present the alternative scenario. The content is provided for purely educational purposes. Final outcomes will depend on the release itself.

On a technical note, we can see that the US Dollar Index created a pivot low on 27.08.2024 4-hour time frame with a reaction higher and as far as the pivot remains intact the index could potentially do a double correction higher to potentially the 103 area, and that would confirm that it is correcting the cycle from 26.06.2024. Alternatively, a break below the pivot could take the Index below the 100 area and if so, that would mean that the cycle from 26.06.2024 hasn’t ended yet.

Let’s see what other major instruments are showing before today’s release.

EURUSD 4HR 26.08.2024 Pivot Signals a potential warning for a double correction lower. Alternatively 1.12000 can be retested or broken.

XAUUSD 4HR Mixed Signals – Caution Ahead – So far 20.08.2024 Pivot Intact – Make or Break Situation For Gold – A Positive NFP Could Produce a move lower

ES500 Mini Futures 4 HR Cycle from 05.08.2024 might have ended – 4hr RSI could break higher short term as far as it hold above the RSI trendline with a positive NFP – Alternatively another move lower might be taking place if negative NFP

Traders need to keep an eye on the NFP release at 13:30 GMT as the data could be the catalyst for the market reaction. The above analysis is purely technical and using the current market data with current pivots. We will provided an update after the Release during the New York session.

If you are new here you can register your trading account at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.