Hello Traders,

In this article we will have a look at Netflix Inc. (NFLX), and analyze the technical outlook before Thursday’s quarterly earnings report. The stock is trading currently at all time highs breaking above the peak from November 2021 and currently at the $715 area.

Netflix, Inc. is an American media company founded in 1997 by Reed Hastings and Marc Randolph in Scotts Valley, California and currently based in Los Gatos, California. It owns and operates an eponymous over-the-top subscription video on-demand service, which showcases acquired and original programming as well as third-party content licensed from other production companies and distributors. Netflix is also the first (and so far only) streaming media company to be a member of the Motion Picture Association.

One of the stocks which manages to make new high above it’s previous peak from 2021, aligning with the strength we have seen thus far is US Indices such as the SP500, Nasdaq & the Dow Jones which is part of. On Thursday, 17th of October the company will announce it’s last quarterly earnings.

For the third quarter of 2024, Netflix forecasts revenues to increase by 14%.The company anticipates total revenues to be $9.77 billion, suggesting growth of 13.9% year over year. Netflix has projected earnings of $5.10 per share, suggesting growth of 36.7% year over year.

*You can trade on Netflix shares through our MT5 platform on all devices: https://www.oneroyal.com/en/markets/instrument/Netflix

Since 2018 Netflix has never missed any of it’s Q3 EPS expectations:

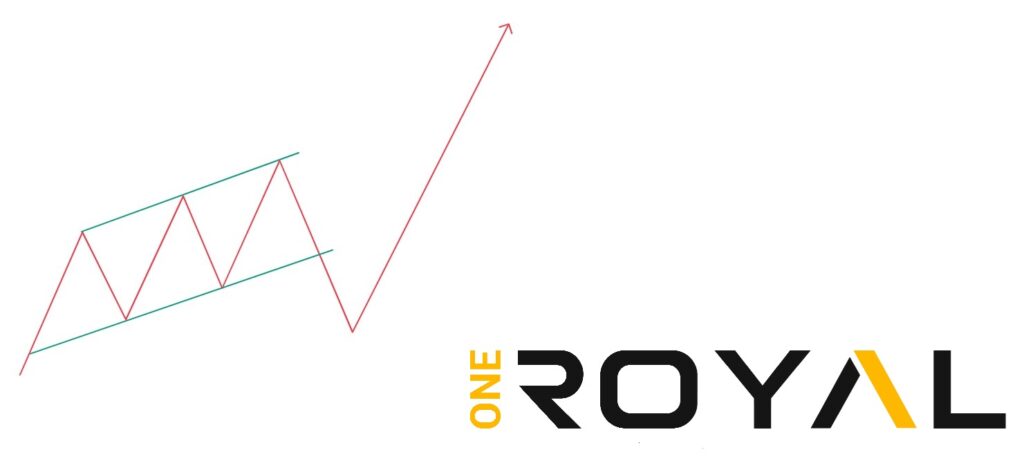

NFLX Technical Outlook – Daily Timeframe Dips Remain Supported Within Channel – Potential Leading Diagonal Wave Structure

As we can see the share price has taken out the highs from 2021 within what looks to be thus far a potential bullish leading diagonal swing structure in the daily time frame.

The structure and swing nature of a leading diagonal looks like the following:

The main pivot for this bullish diagonal remain the lows from April 2024 around the $540 and as far as it remains above Netflix has scope to potentially extend higher. In the short term, depending on the earnings report on Thursday it will define whether there will be any volatility and whether the price action should respect the potential leading diagonal swing structure.

Investors will be paying attention to the report on Thursday and take decisions accordingly. It would be interesting whether this Q3 earnings report would be the 7th in a row in which Netflix meets or exceeds expectations both on EPS as well as revenue wise. In the event of any short term potential volatility, traders should keep in mind the pivot from 04.2024 & 08.2024 for their risk management and decision making process on the technical side of the market.

*You can trade on Netflix shares through our MT5 platform on all devices: https://www.oneroyal.com/en/markets/instrument/Netflix

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.