Hello Traders,

Hopefully everyone is having a great day, and in this article, we will be explaining the various possibilities in terms of the upcoming NFP data so that you will be educated and informed about the various possibilities and outcomes of such release.

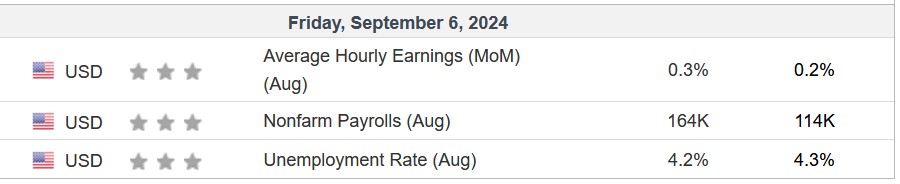

It’s important to understand that on every NFP release we have 3 important pieces of data which are the actual monthly Nonfarm Payrolls, the average hourly earnings and the unemployment rate as indicated with the table below from investing.com:

Having those in consideration, we should see then how different or mixed results can impact the market. On the right hand side, we have the previous month’s releases and on the left the forecasts for this Friday’s releases.

A higher than expected Nonfarm Payroll release is considered positive for the US economy and thus the US Dollar can potentially gain value. The opposite goes for the unemployment rate which a higher number should be consider as negative for the US economy and thus the US Dollar could potentially lose value. In a scenario in which one is higher and the other one lower if the differences are not significant markets tend to stay sideways.

However, considering the recent market volatility we saw last month how forecasts can be way off and create big moves in the markets. A scenario where the NFP number is higher than expected and unemployment even slightly lower can potentially boost the US dollar value across the market and in return the US stock market. More specially, financial instruments to pay attention to from forex should be pairs such as the EURUSD, GBPUSD, USDJPY for example and from US stock markets, indices such as the S&P 500, Nasdaq, or the US30/ Dow Jones. A positive outlook can potentially boost prices in US stock markets. A lower than expected release as well with the same or higher unemployment rate could potentially have a negative impact for the US Dollar and US stock markets which is what we have experienced during last month’s release.

Metals such as Gold & Silver could also be affected significantly where in cases of good NFP releases they tend to drop in value as they trade and being measured in dollar terms. A worst than expected release could potentially boost the value of such metals as they can also act as a hedge against a weak and uncertain economic outlook.

It is also important to note that the upcoming NFP releases from now onwards could potentially be of greater significance as the results could potentially impact on how the US Federal reserve decides on the degree of the potential upcoming interest rate cuts that we might start seeing from the following FOMC meeting on September the 18th and this can have a significant impact on the way markets react in the short term as investors will be considering whether they should stay long in the stock market or short, a debate whether the US economic outlook remains solid or weakening and a period of a potential short term volatility might be in play.

In our next article we will showcase what has happened in the previous month’s NFP release.

Stay tuned as well for tomorrow’s morning market outlook before the release. If you are new here and you do not have a trading account with us, you can consider joining at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.