Weekly Recap

It’s been another week of big volatility and important developments across financial markets. The week commenced on a negative note following news of wide-spread protests and civil unrest in China as citizens protested the government’s zero-covid policy in the wake of 10 deaths during a tower fire. Scenes of clashes between protestors and police fueled a wave of uncertainty which saw risk markets opening the week lower before recovering as the protests died down and China eased covid restrictions in some places. However, the situation remains on-going and it is still not clear whether the government will abandon its zero covid policy, especially with cases still surging higher there.

Into the middle of the week, the big focus was on Fed chairman Powell’s speech at the Brookings Institute. Powell told markets that the Fed was in agreement that it would soon be appropriate to slow the pace of rate hikes, likely as early as the December meeting. USD was heavily sold on this news and continued lower into the end of the week as a weaker-than-forecast core PCE reading adding to dovish expectations ahead of the December FOMC meeting.

Looking ahead, the US labour reports will be closely watched. Given the built up dovish expectations in the market it would likely take a stark upside surprise to stem the sell-off in USD and cause any shift in market pricing for the December FOMC meeting.

JPY was seen taking advantage of the reversal in USD this week. Along with residual safe-haven demand linked to the uncertainty around China, JPY was seen making strong gains across the board including against risk currencies as mixed equities performance failed to light a fire under high beta FX.

Metals were some of the big winners this week, with both gold and silver futures seen breaking out as USD came off. Oil prices rallied off the initial lows printed earlier in the week in response to a de-escalation of the China covid story, however the greater focus remains the OPEC meeting coming this weekend. With no further adjustments expected, oil prices are vulnerable to volatility if we see any surprises.

Coming Up This Week

- RBA December Meeting

The upcoming RBA meeting will be closely watched this week. The RBA has pivoted away from faster tightening over the last two meetings, slowing the pace of its rate hikes. The market is widely expecting a further 25bps hike from the RBA. However, on the back of recent comments from RBA governor Lowe, warning that rates are subject to change as the bank monitors inflation, there is still two-way risk into the meeting and a larger hike cannot be ruled out.

- BOC December Meeting

Following the RBA meeting, the market will then turn its attention to the BOC which meets on Wednesday. Consensus forecasts are built around a further 50bps hike with the expectation that the bank will also announce a pause in its tightening programme after this meeting. If delivered, this should see CAD lower near-term. Any surprise signal that further rates are needed will see a sharp bid under CAD.

- US Services PMI & PPI

The latest US services PMI and PPI data will be closely watched this week as traders continue to try and gauge how the Fed is likely to act at the December FOMC. On the back of recent dovish comments from Fed chairman Powell, the market is widely expecting a slower pace of hikes. Any data weakness this week should further endorse this view. Given these expectations it would likely take a sharp surprise in this week’s data to fuel a shift in this view.

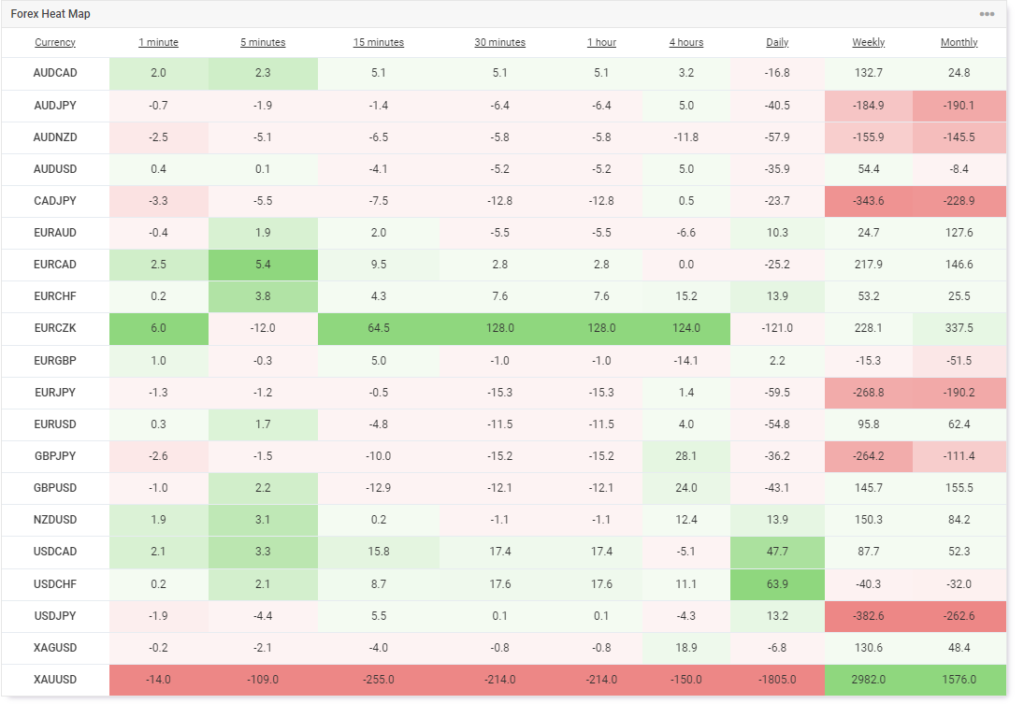

Forex Heat Map

Source: Myfxbook

Technical Analysis

Our favorite technical chart of the week – Silver (XAGUSD)

The reversal higher in silver off the 18.16782 lows has seen the market breaking above the local bear channel and above the 20.6988 level. Price is now attempting to break above the 22.5239 level. This is a key area for the market and a break higher here will put a test of the long term bear trend line in view ahead of the larger 227652 resistance level above. To the downside, any retracement should find support into 20.6988 to keep the medium-term outlook bullish.

Economic Calendar

Plenty to keep an eye on this week data-wise, with the RBA and BOC rates meeting, Eurozone retail sales and US PPI among other key events and releases. See the calendar below for the full schedule.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.

Sources: Bloomberg, CNBC, Reuters

Original article provided by Trading Writers