Hello Traders,

In this article we will provide the technical outlook for the USD and certain related forex pairs ahead of this week’s jobs data and NFP. The USD has been under pressure within the second half of 2024 mainly as markets pricing in interest rate cuts as well as the weakness in US labor market and unemployment. As of recent the USD revisited the 100 area in which has been an area of interest both last year on 14.07.2024 at 99.600 as well as 28.12,2023 at 100.600. The levels provided twice support for the USD for a significant reaction to the upside. For the time being, bulls are managing to maintain the area of 100 with the main focus to be the jobs and labor data this week. Dollar bulls need a better labor outlook to push higher while any signs of weakness should be what sellers are looking for. Having said that let’s see most USD Major related pairs technical outlook and levels to watch for. For all charts we will be looking at their respective 8 hr timeframes.

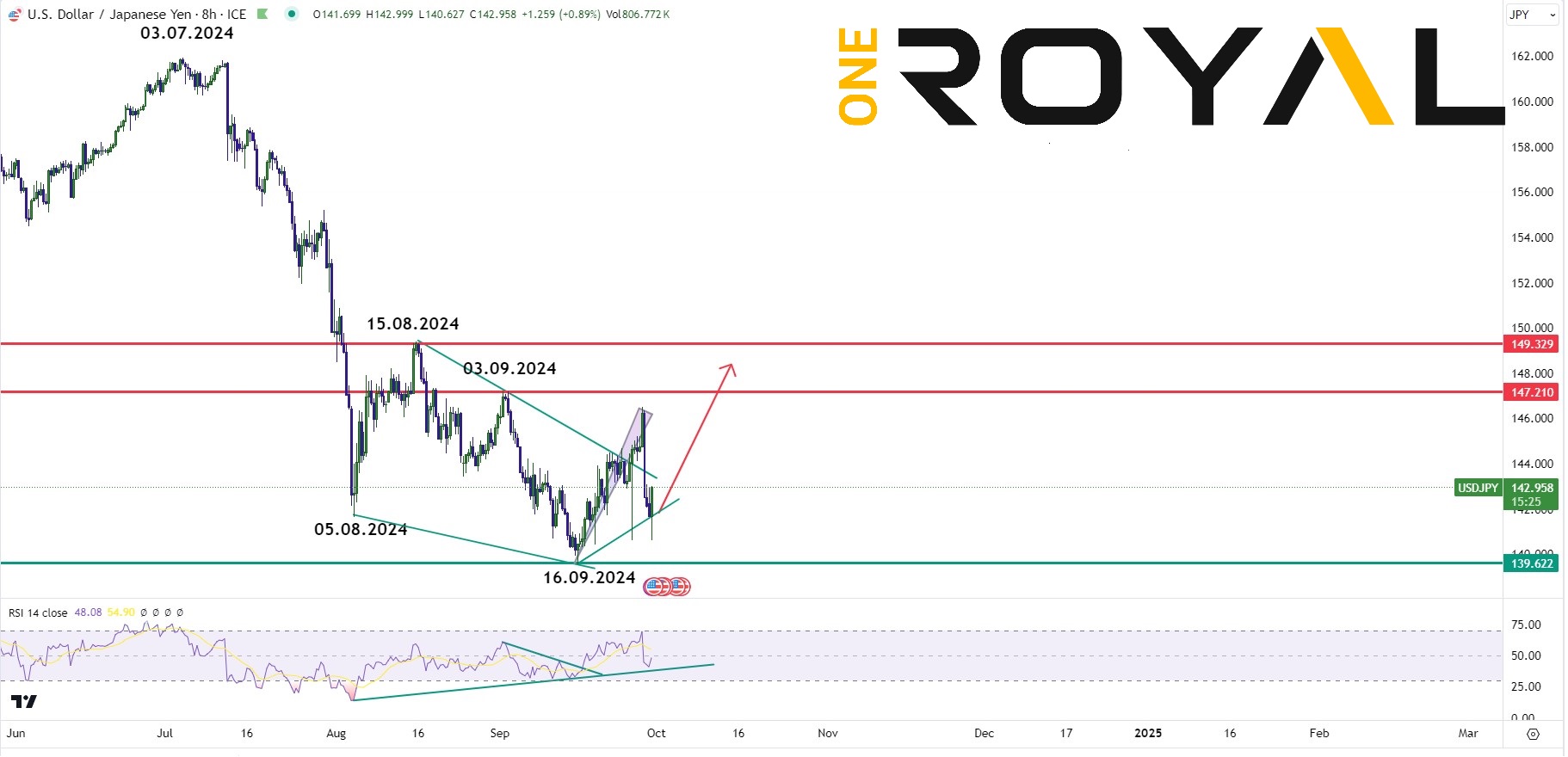

USDJPY – Bulls Looking To Defend 16.09.2024 – lows for the 147 – 149 area – Sellers Need To Break Below It Looking for The 135 – 137 Area

EURUSD – Bulls Need To Hold The RSI Trendline and Break Decisively 1.12000 Looking For 1.13000 – 1.14000 – Otherwise Sellers Can Take It Lower Towards 1.09000 – 1.10000 Area

AUDUSD – Strength Since 05.08.2024 Lows Cycle From 11.09.2024 Intact – Bulls Looking For 0.7000 Or Sellers To Bring it Lower Towards 0.68200 – 0.67300 area – RSI Trendline In Focus

USDCHF Support Is Holding from 0.84000 – 0.83300 area – Buyers Will Be Looking For 0.87000 – 0.87500 Area If Positive US Data While Sellers Will Need To Break Decisively Below 0.83300 – RSI Trendline In Focus

These were some of the main major USD related pairs and this week should be a decision week as the market should decide on the next move and reaction to take place according to the upcoming labor data which kicks off tomorrow with JOLTs Job Openings data at 15:00 GMT, followed by ADP employment on Wednesday and then Jobless claims on Thursday as the main NFP and unemployment data is due for Friday 13:30 GMT.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.