Hello Traders,

Post US Elections and FOMC with Donald Trump being elected as the 47th president of the US, and the US Federal Reserve cutting rates by 25 bps as was expected by the forecasts, we are heading for a CPI week ahead. The markets remained optimistic last week with the US indices making new all time highs for all the big 3, SP500, Nasdaq, Dow Jones. Additionally, Bitcoin has also followed up with a new all time high and the $80k short term trend based Fibonacci extension area target has been reached. This week it should be a week in which the US Dollar awaits the CPI figures to determine the next move. If inflations cools down further or remains under control, the dollar might be set for a period of weakness after the recovery rally from 27.09.2024 and post US Elections. Any signs of rising CPI could add further strength to it.

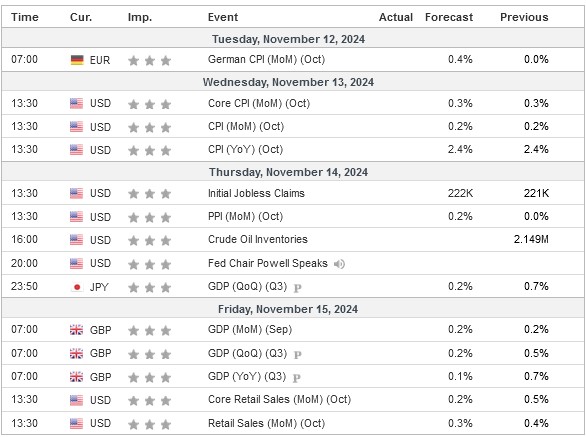

Weekly Calendar – High Impact News In GMT (investing.com)

Importance to be noted as well for the following day’s PPI and Fed’s chairman Jerome Powell speech, and the next day’s retail sales. UK’s & Japan’s GDP is also due at the end of this week. With such economic events this week, a potential volatility might be ahead of us especially if there will be any surprises to the actual CPI numbers ahead. As markets pricing in a cooling inflation data any spikes could cause volatility or fear in the overall markets.

Market Technical Outlook

USDX Daily Time Frame- Retesting Major Trendline From 03.10.2023

EURUSD DAILY – Retest of June’s Lows & Key Area For 2024

USDJPY – Cycle From 16.09.2024 Remains Intact Unless RSI Breaks Below The Highlighted Contraction – Current Price Action Suggests That A Potential Bullish Leading Diagonal Might Be In Play – US CPI & Japan’s GDP Important

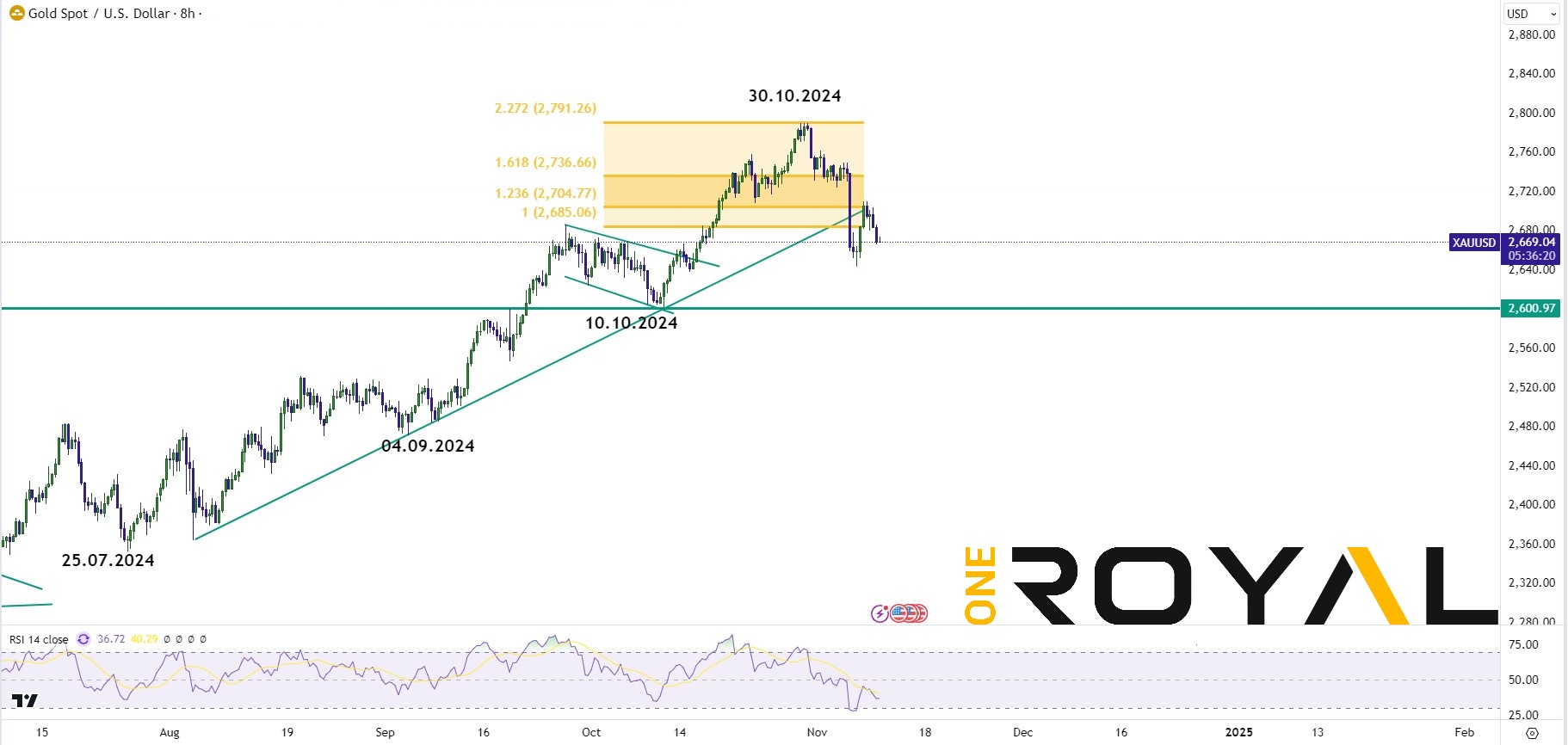

XAUUSD – Bulls Lost Momentum – Peak From 30.10.2024 Might Suggest A Bigger Pullback Might Be Taking Place Towards the 10.10.2024 Lows or Lower As Far As It Remains Below 30.10.2024

ES500 Mini Futures – Cycle From 05.08.2024 Remains Supported As The Index Hits A Trend Based Fibonacci Extension Target Area For The Bulls – As Far As Above 04.11.2024 Lows Dips Could Remain Supported

That’s the overall market picture we have starting off this week and traders should be anticipating the CPI numbers for any further hints to the next market move. EURUSD remains at a critical area and thus far continued to show weakness following up the US Elections as the fears from Donald Trumps tariffs intensified. Gold is also at a key decision moment with bulls appear to have lost the strong momentum last week and the CPI should be important if there will be any surprises and turns, as Indices such as ES500 continued higher to all time highs.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.