Hello Traders,

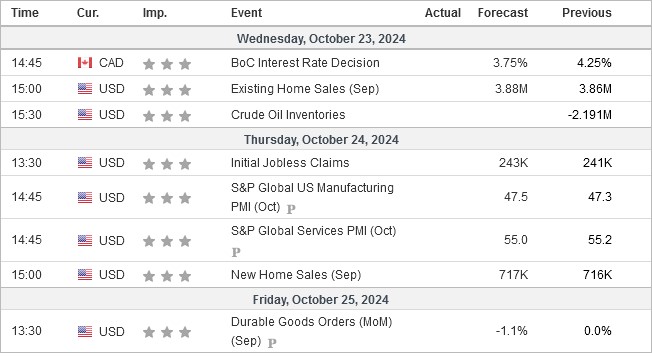

For this week, high impact economic releases remain at minimal with the main focus being the BoC interest rate decision and the US S&P Global Manufacturing & Services PMI as well as new home sales, in a relatively calmer week for this month before heading into the key month of November late next week. As next week, the US jobs data comes back in focus. with US elections thereafter and then the FOMC meeting. Other than the economic calendar this week the BRICS summit is taking place in Kazan between Tuesday & Thursday, in which we could expect news related to new trade agreements, and any further potential shifts the BRICS alliance is looking to bring up and how Russia moves into the new future after being sanctioned by the West. Talks related to how digital currencies could be utilized for BRICS trade agreements and arrangements could bring up more pressure against the USD and the traditional standard.

Weekly High Impact Economic Releases (London Time – Source: investing.com)

BoC is expected to come in with a 0.50% interest rate cut following this year’s overall trend with rate cuts from ECB & the US Federal reserve. Crude Oil despite of the efforts of supply reduction remains under pressure with more weakness taking place over the past 2 weeks and prices back at the $70 range, with the BRICS Summit in focus and them market looking for any new hints to the future of trade agreements.

Market Technical Outlook

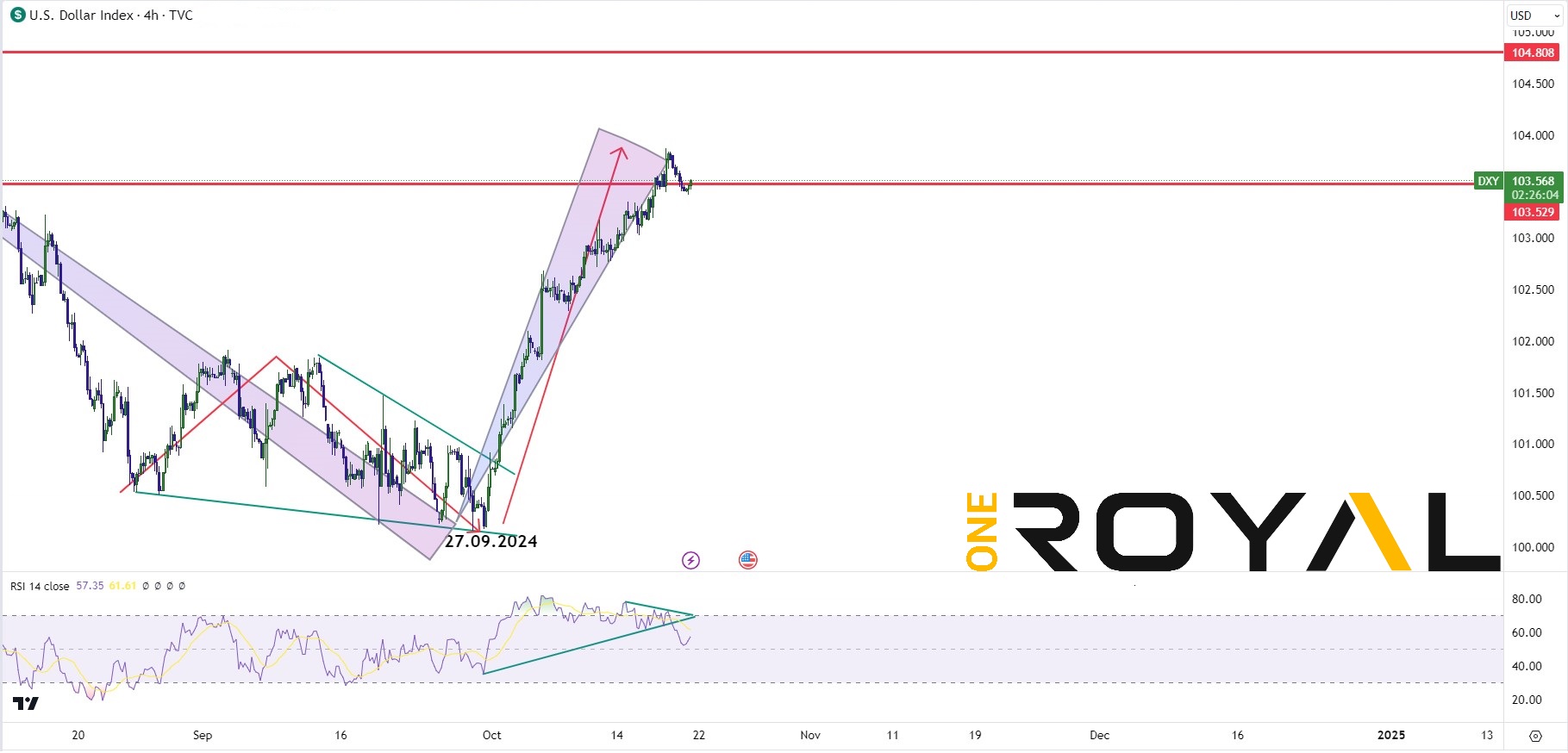

USDX 4HR – Recovery Rally From 27.09.2024 Starts To Show Signs Of Potential Weakness Short Term

EURUSD 4HR – The Move Lower From 25.09.2024 Showing Signs Of Momentum Loss – Potential Reaction Might Be Expected

USDCAD 4HR – Rally From 25.09.2024 Retesting 05.08.2024 – Signs Of Potential Exhaustion & Reaction Might Be Anticipated Soon

XAUUSD 4HR – Buyers Staying In Control – Big Strength Continues – Dips To Potentially Remain Supported Heading Into the Next Fib Extension of $2791.26

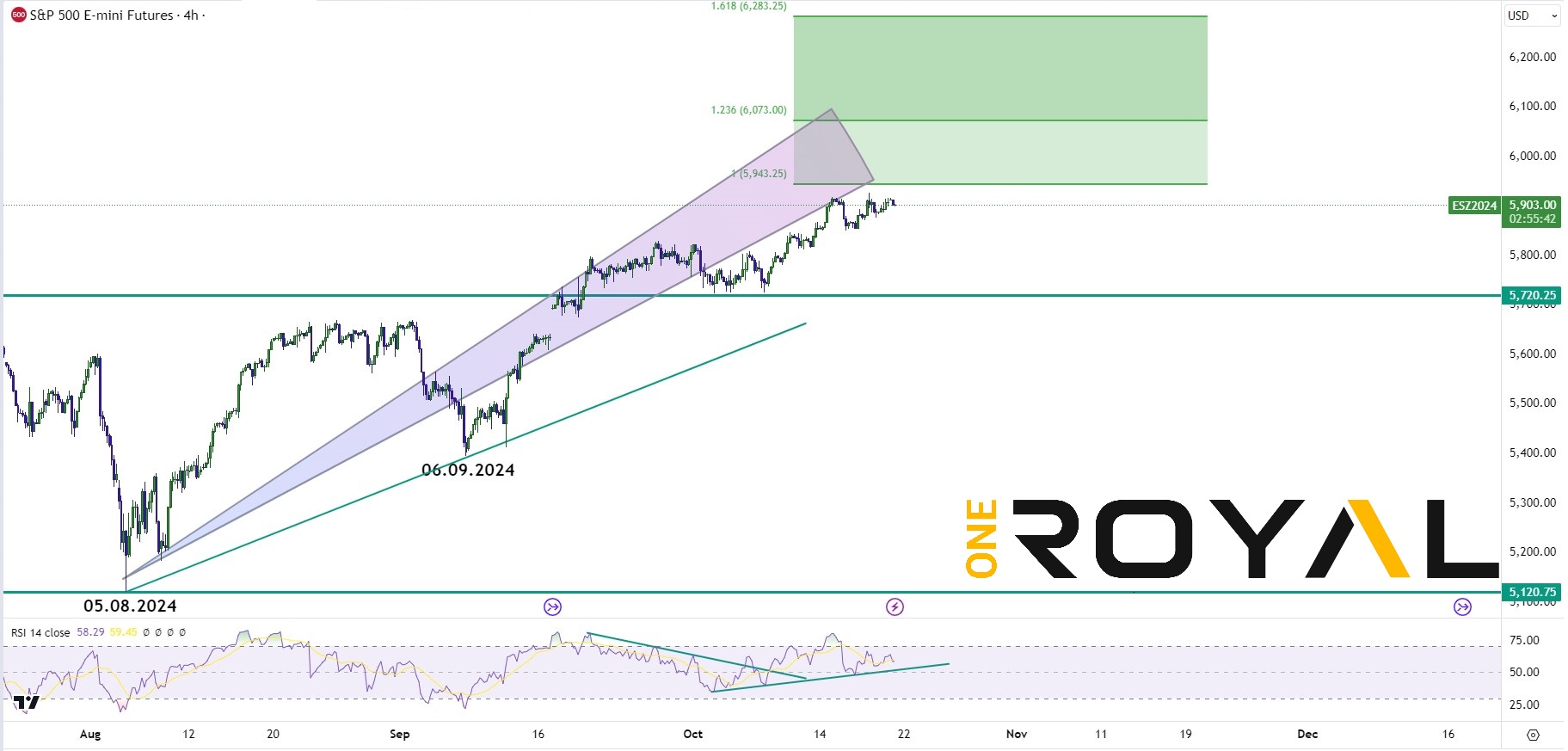

ES500 Mini Futures – Cycle From 05.08.2024 Remains Intact – Shorter Term Cycle Remains Intact From Buyers – Dips To Potentially Find Support For the Fibonacci Extension Area Above

Those are the main highlights for this week of trading before heading into the new month ahead. It will be interesting to see for any new hints from the BRICS summit as well as whether the Bank Of Canada follows up with the expected 0.50% rate cut, as well as how the US Dollar reacts with the US data. From the market’s technical point of view we might be heading for a USDX exhaustion from the recent rally and a potential reaction into weakness for at least the short term might be seen.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.