.Hello Traders,

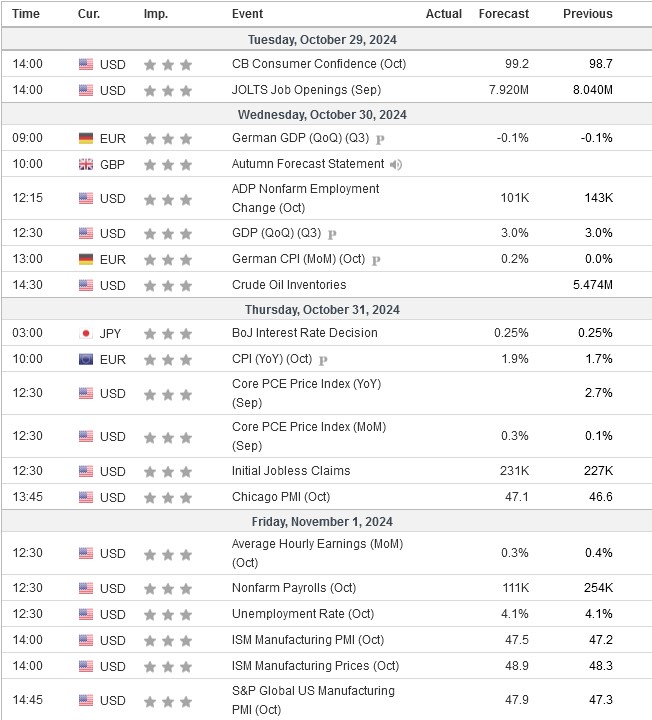

We have reached the final week of October with a lot of upcoming news and economic releases ahead. This week the US Jobs data are the main highlight, with GDP & Core PCE secondarily and the BoJ’s Interest rate decision before the US Nonfarm Payrolls. Furthermore, next week we have the US Elections as well as the FOMC Interest Rate decision, the market overall might see volatility and traders should be more aware in terms of their risk management ahead of those events.

The Calendar – GMT (Source investing.com)

Market Technical Outlook

USDX 4HR – Still Within 27.09.2024 Cycle & Within Potential Resistance Area – US Jobs Data Likely The Decision Maker For The Next Move

.

EURUSD 4HR – Stalled At Possible Support Area – RSI Might Be Hinting To A Potential Recovery Bounce – US Jobs Data To Decide The Reaction

XAUUSD 4HR – 10.10.2024 Remains Intact – Another Breakout Might Reach 2.272 Inverse Fib Extension Area

Crude Oil Futures – Remained Under Pressure After BRICS Summit & High Inventory Supply – Testing Key Area – Reaction To Determine Whether More Sideways Range $65 – $75 Or Whether Soon A Break Below $65

ES500 Mini Futures – Cycles From 05.08.2024 & 06.09.2024 Remain Intact- Slight Weakness Can Be Seen – US Jobs Data To Be The Deciding Factor Whether a move towards $6000 or a move lower towards $5700 or below

It’s all about the US Jobs data this week starting with tomorrow’s JOLTS Job Openings & consumer confidence which are likely to affect both the US Dollar & the US Equities as they should be sensitive to any potential shifts in the jobs market overall. Lower numbers are likely to cause fear as well a fall in the USDX while any positive numbers are likely to allow the USDX to remain supported and US Equities to continue finding support for further upside.

US Crude Oil Inventories this week might determine whether a recovery bounce can happen or whether more downside in crude oil prices while Gold is likely to get volatile with any unexpected data from the US jobs market.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.