Hello Traders,

Hopefully everyone has enjoyed the weekend as we are entering into an important key week in terms of key interest rate decisions from the US Fed, Bank Of England & Bank Of Japan. This is a week in which traders can anticipate volatility in the markets as these key decisions come into play after last week’s ECB 60 basis points interest rate cut. We have seen Gold reaching all time highs in response to the rate cut from ECB and upcoming US Fed’s rate cut. Stock markets and Indices reacted higher as well while the US Dollar remained weaker in a mixed data week with lower CPI but higher Core CPI and higher PPI.

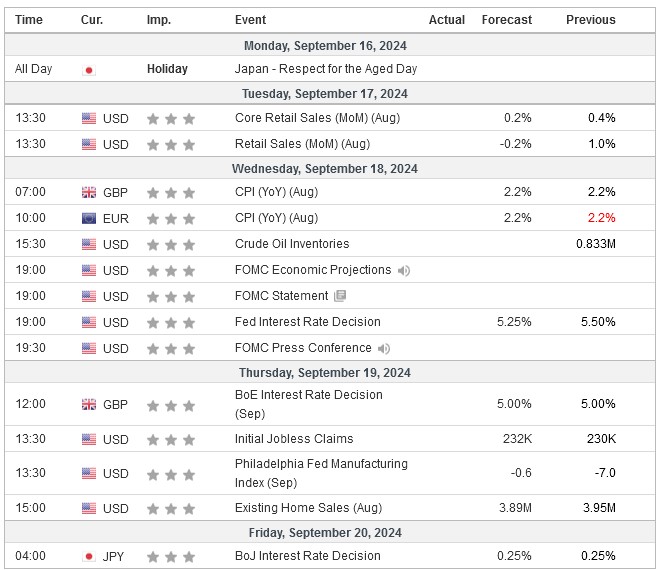

This week’s focus will be whether the markets have already priced in Fed’s 25 basis point cut and whether this will be the actual cut we will see. As well as analysts according to investing.com are forecasting BoE and BoJ to remain neutral and not adjust their interest rates. Additionally, tomorrow at 13:30 GMT US Retail Sales data is expected to come out.

Table & Data Provided By investing.com

Let’s have a look at the main markets technical levels to watch for for the next potential move ahead.

USDX – 4HR 27.08.2024 Pivot So Far Remains Intact 102.500 – 103 Area Could Be In Play – A Break Lower Would Change The Structure & Cycle

EURUSD 4 HR – As Far as Below the Trendline & Or Previous Peak From September the 6th Another Move Lower Could Take Place – Otherwise New Highs Might Be Seen

XAUUSD 4HR – Bigger Picture Still Bullish – Possible pullback might be retesting either of the 2 cycle from 05.08.2024 trendlines If USDX Will Hold 27.08.2024 Pivot & React Higher

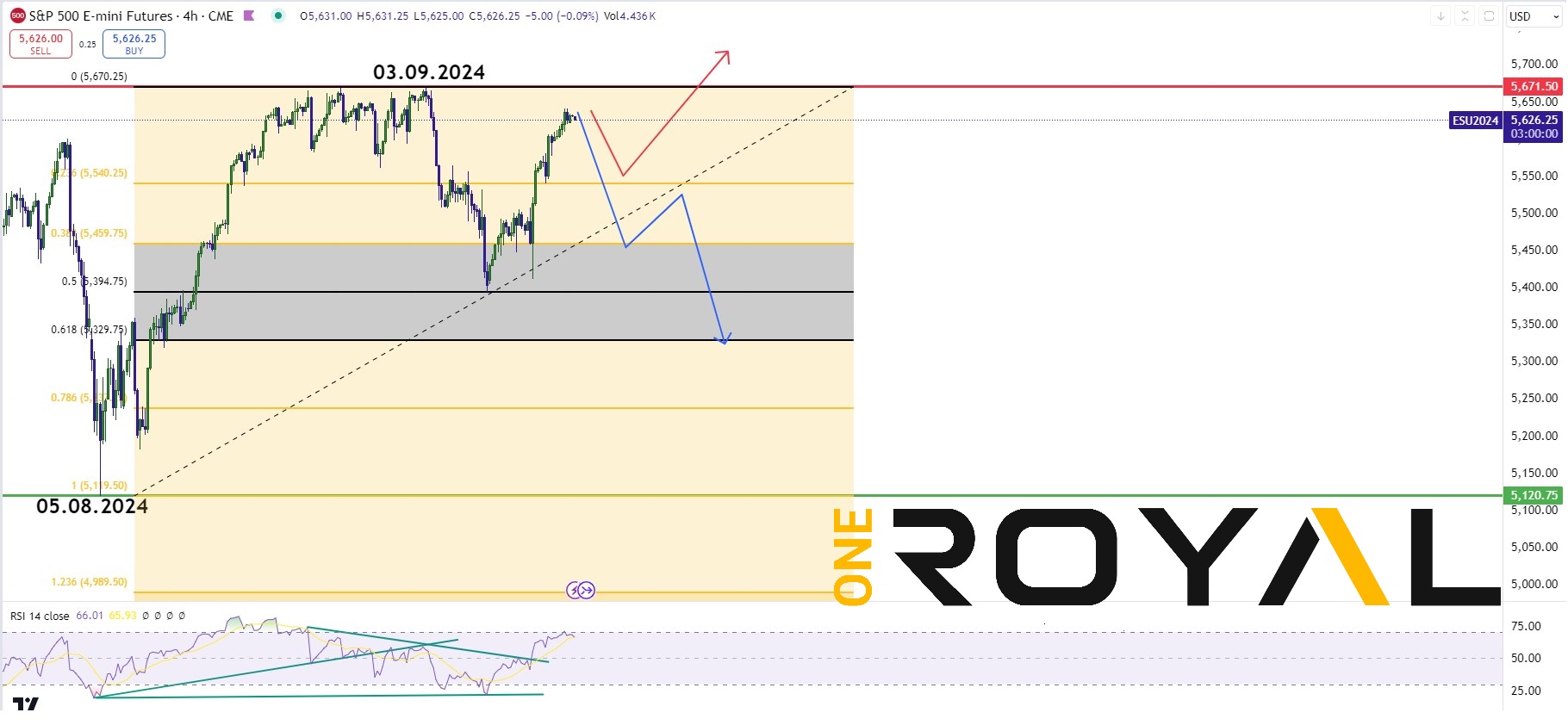

ES500 Mini Futures – 4HR – Make Or Break Moment – Reaction Higher after a 0.5% Pullback From 03.09.2024 Peak – As Far as Below The Peak A possible Double Correction Might Happen, Otherwise New Highs Could be In Play

Those were the main markets in terms of their technical analysis early this week, as we have entered into a key and volatile week, traders will be anticipating the rate decisions within the week while it’s important to see whether the markets have already been pricing in the US rate cut or whether the market has still room in the short term to continue with a weak US Dollar and Gold to continue making new all time highs followed by US Indices such as the ES500.

We will be providing an exclusive article about the US FOMC before the event which will be taking place on Wednesday 18.09.2024 at 19:00 GMT Time.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.