Hello Traders,

Welcome to another week of trading, post FOMC’s rate cut and let’s see what this week has in play before the new month of October. This week the focus is shifting towards US Consumer Confidence, GDP. Powell’s speech and PCE data while outside of US we have RBA’s interest rate decision and SNB’S one.

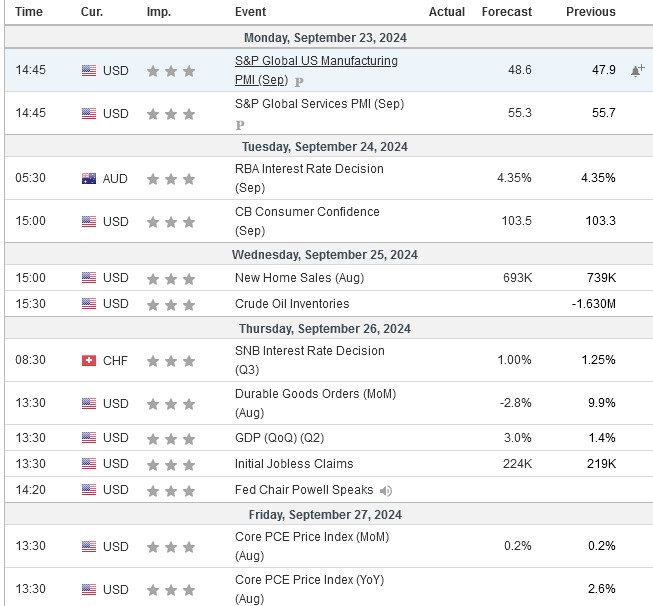

Weekly High Impact News – September 23rd – 27th 2024 (GMT)

A couple of key highlights to keep an eye on from this week’s important economic releases should be the expectations from analysts about SNB’s rate cut, a potential drop in US durable good while a significant rise in GDP and on Friday Core PCE might be key as any increase there can cause some short term market fear dips. Traders should also keep an eye on the market technical analysis for any potential next move ahead this week. Let’s have a look on the relevant forex pairs that might be affected from these releases as well as Gold & ES500 mini futures.

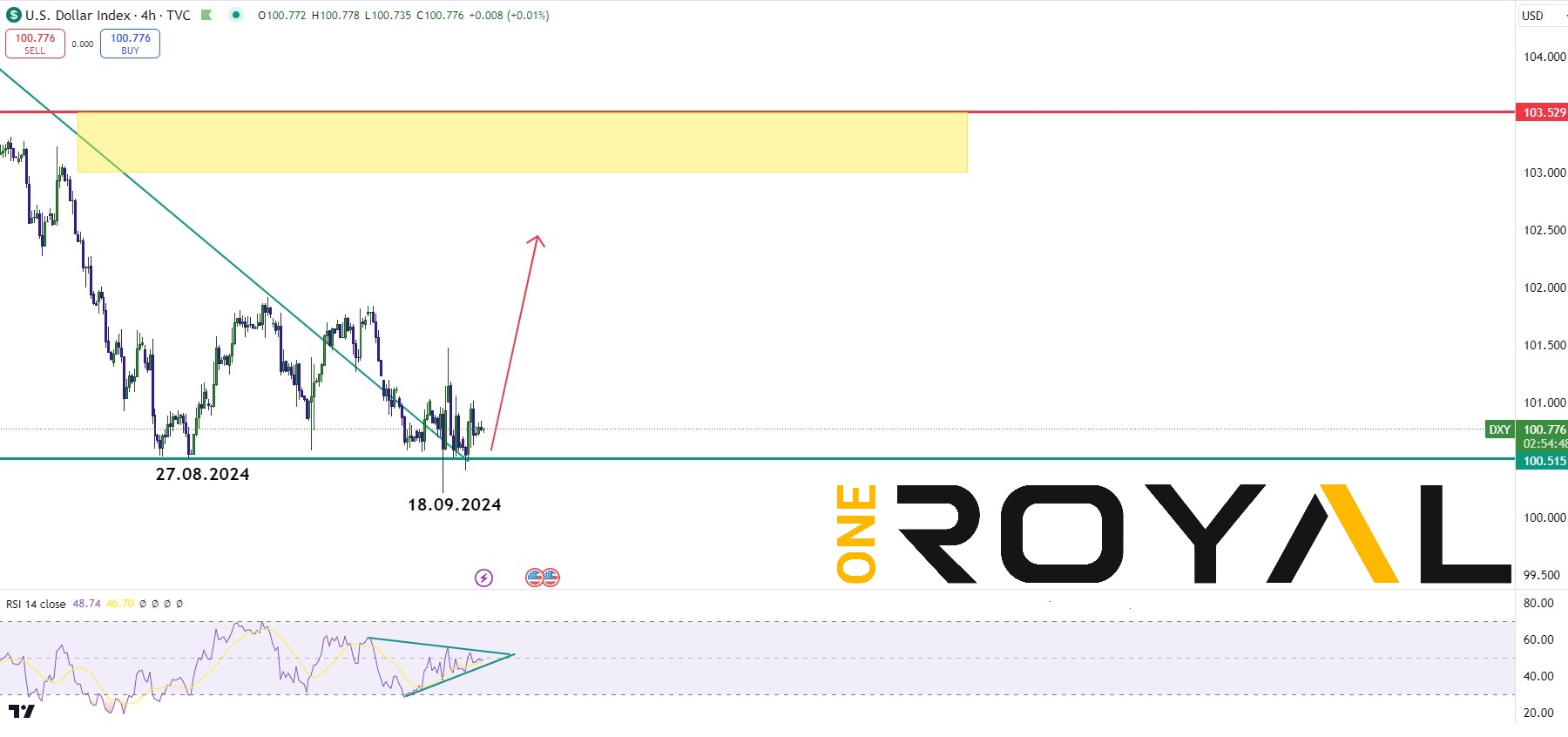

USDX 4HR – 18.09.2024 Move Lower Didn’t Close below 27.08.2024 Which Remains The Main Pivot – RSI Triangle Break Higher Or Lower To Indicate The Next Move – Decision Week

AUDUSD 4HR – 05.08.2024 Main Trend Pivot – 11.09.2024 Short Term Pivot Cycle – Potential RSI Weakness & Failure To Break To New Highs Might Indicate Soon A Pullback

USDCHF 4 HR 29.08.2024 Remains The Pivot As Previous Dips Failed To Close lower – SNB’s Potential Rate Cut Might Potentially Support CHF Weakness – A Decision Week For USDCHF

XAUUSD 4HR – Cycle From 25.07.2024 Might Be Mature – Potential RSI Weakness/Divergence To Look For Might Signal A Small Warning For Buyers Short Term – 2 Trendlines To Watch Out For

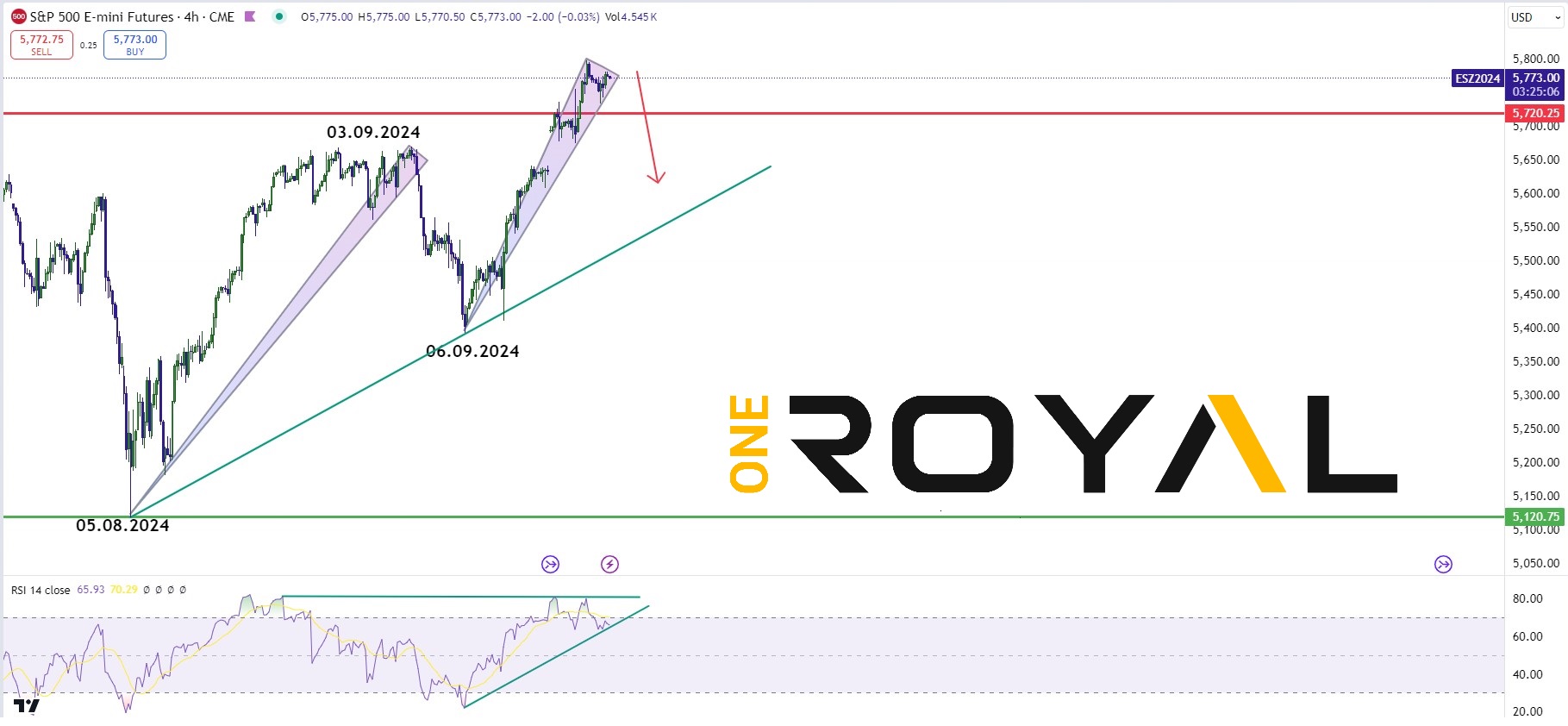

ES500 Mini Futures 4HR – New All Time High – Short Term Cycle From 06.09.2024 Might Be Mature – Continuous RSI Weakness Might Lead To A Pullback Dip – Trendline In Focus

These are the main technical analysis for the week ahead as this might be a decisive week for the US Dollar with the upcoming news releases to dictate the next move and whether the pivot from 27.08.2024 will hold for a reaction near term. XAUUSD & ES500 to indicate if weakness in momentum continues a potential pullback or if more strength mitigates any weakness. Traders should keep in mind the respective technical market pivots for the week ahead.

If you are new here and you do not already have a trading account you can sign up at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.