By Motasm Adel, Financial Market Analyst

March 27, 2025

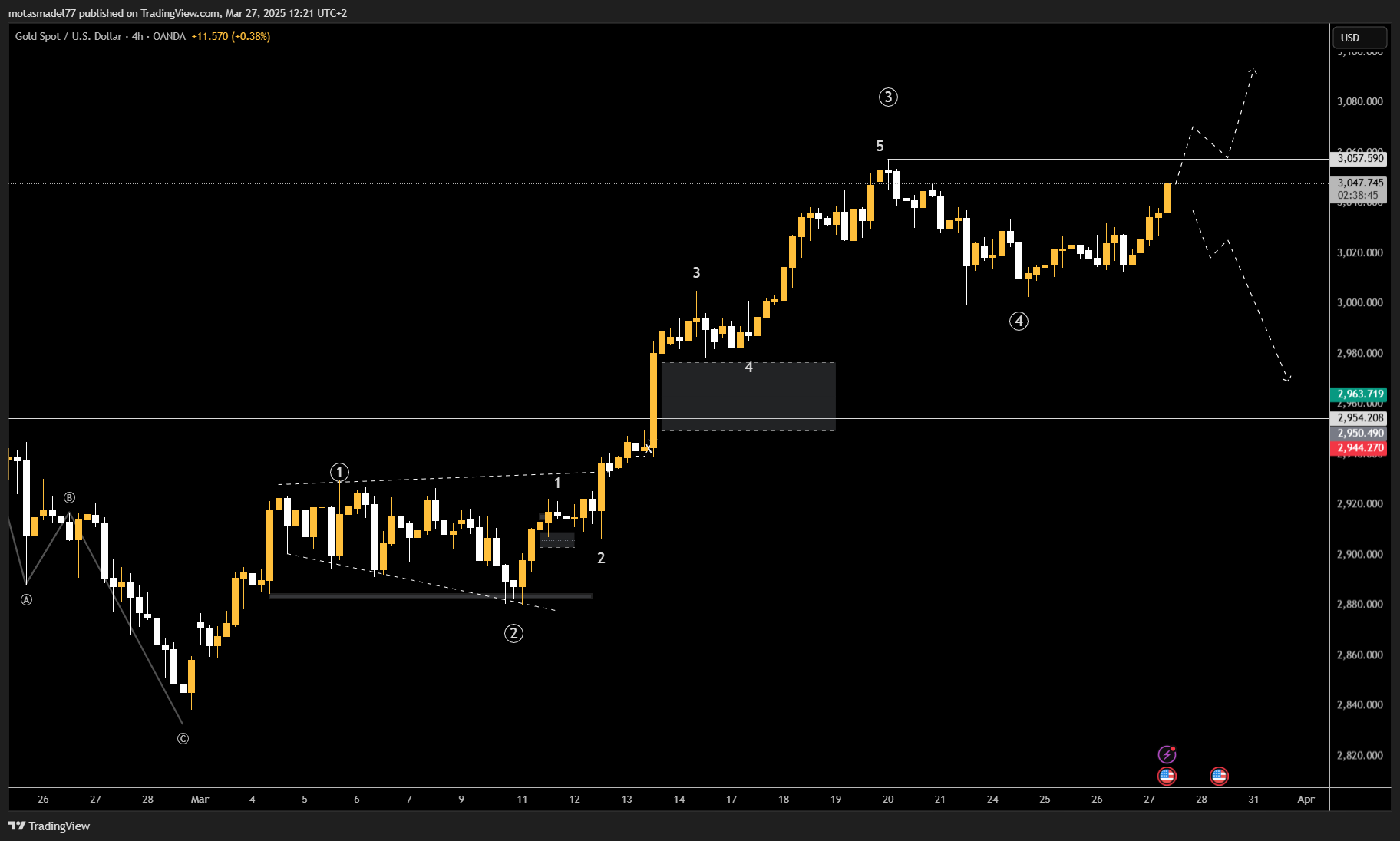

Following our previous analysis, where we highlighted that gold had completed its third bullish wave at $3,057.59 and entered a corrective fourth wave, the market has reacted precisely as expected. Gold retraced to $3,000, aligning with our forecast, before rebounding sharply to its current level of $3,055 per ounce. The key question now is whether this marks the end of the correction and the continuation of the bullish trend, or if this is merely a liquidity grab before further downside correction.

Gold’s Next Move: Key Levels and Scenarios

Gold’s current strength suggests the possibility of extending its rally toward $3,100 in April, aligning with the formation of the fifth bullish wave.

However, the upcoming economic data releases will play a crucial role in determining the next directional move for gold:

- USD-ISM Manufacturing PMI – Tuesday, April 1

- USD-JOLTS Job Openings – Tuesday, April 1

- USD-ADP Non-Farm Employment Change – Wednesday, April 2

- USD-Unemployment Claims – Thursday, April 3

- USD-Average Hourly Earnings m/m – Friday, April 4

If these reports come out negative for the US dollar, they could reinforce gold’s bullish momentum, pushing it towards new highs. Conversely, if the data is positive for the dollar, strengthening the currency, gold may face renewed selling pressure. A confirmed daily close below $2,999.465 would indicate the continuation of the correction, with a potential decline toward the $2,970 support level.

Broader Market Implications

Aside from gold, the strength of the US dollar and interest rate expectations will be key drivers of market sentiment. A hawkish stance from the Federal Reserve or strong labor market data could bolster the dollar, affecting both gold and major indices. Investors should closely monitor these economic indicators to adjust their positions accordingly.

Final Thoughts

With gold at a pivotal point, the upcoming economic releases will serve as a catalyst for its next major move. Traders should remain cautious and adaptable, keeping an eye on key technical levels and macroeconomic trends to navigate market fluctuations effectively.

Risk Disclaimer: This information is for educational purposes only and does not constitute investment advice. Financial markets involve risks, and past performance is not indicative of future results. Always conduct your own research and seek professional advice before making investment decisions.

Risk Warning: High-risk investments may lead to total capital loss.