Hello Traders,

Good morning to all and hopefully everyone has had a great weekend. After last week’s NFP release we are entering into a busy week ahead with multiple key Economic releases which could potential cause big market reactions and volatility ahead. We have started the week with an early Asian session release from Japan, their (QoQ) (Q2) GDP which came in at 0.7% a 0.1% miss from the analysts expectations and thus providing a negative reaction to the YEN. All economic data provided from investing.com Let’s have a look at the USDJPY’S technical analysis 4hr chart below:

USDJPY 4 HR – 05.08.2024 141.667 Low Could Be Key & Cause Challenges for Sellers With A Potential Bounce Higher Aiming for the 150’s Otherwise A Break Lower Could Expose the 140 Area – RSI Key For Break Out or Break Down

Tomorrow at 07:00 GMT early London Session, Germany’s CPI will be out however, the bigger focus this week might lean more towards US CPI on Wednesday 13:30 GMT 11th of September, while the next day Thursday 12th of September we will have the ECB’S Interest rate decision at 13:15 whereby a 60 basis point cut is forecast by analysts. Additionally later during that day at 13:30 GMT US Initial Jobless Claims & US PPI will be out minutes before ECB’S Press Conference. As the week is lining up with a more likely scenario of the ECB coming up with an interest rate cut, this could expose weakness in the Euro while US CPI the day earlier could Impact significantly the US Dollar and thus making the EURUSD a highly volatility pair within this week.

Previous US CPI came up at 2.9% and now analysts are expecting it lower towards 2.6%. A miss of the forecast and a higher CPI could provide a significant reaction higher in the US Dollar Index, while the next day’s ECB’s rate cut could weaken the Euro. Traders need to pay attention to both days news in terms of the market’s next move as a mixed reading could also provide a sideways market as well. Let’s now have a look at the technical analysis for the US Dollar, EUR as well as Gold and SP500 to see where we are.

USDX – 4 HR Still Looking To Extend Higher Towards The 103 Area As Far as 27.08.2024 Pivot Provides Support

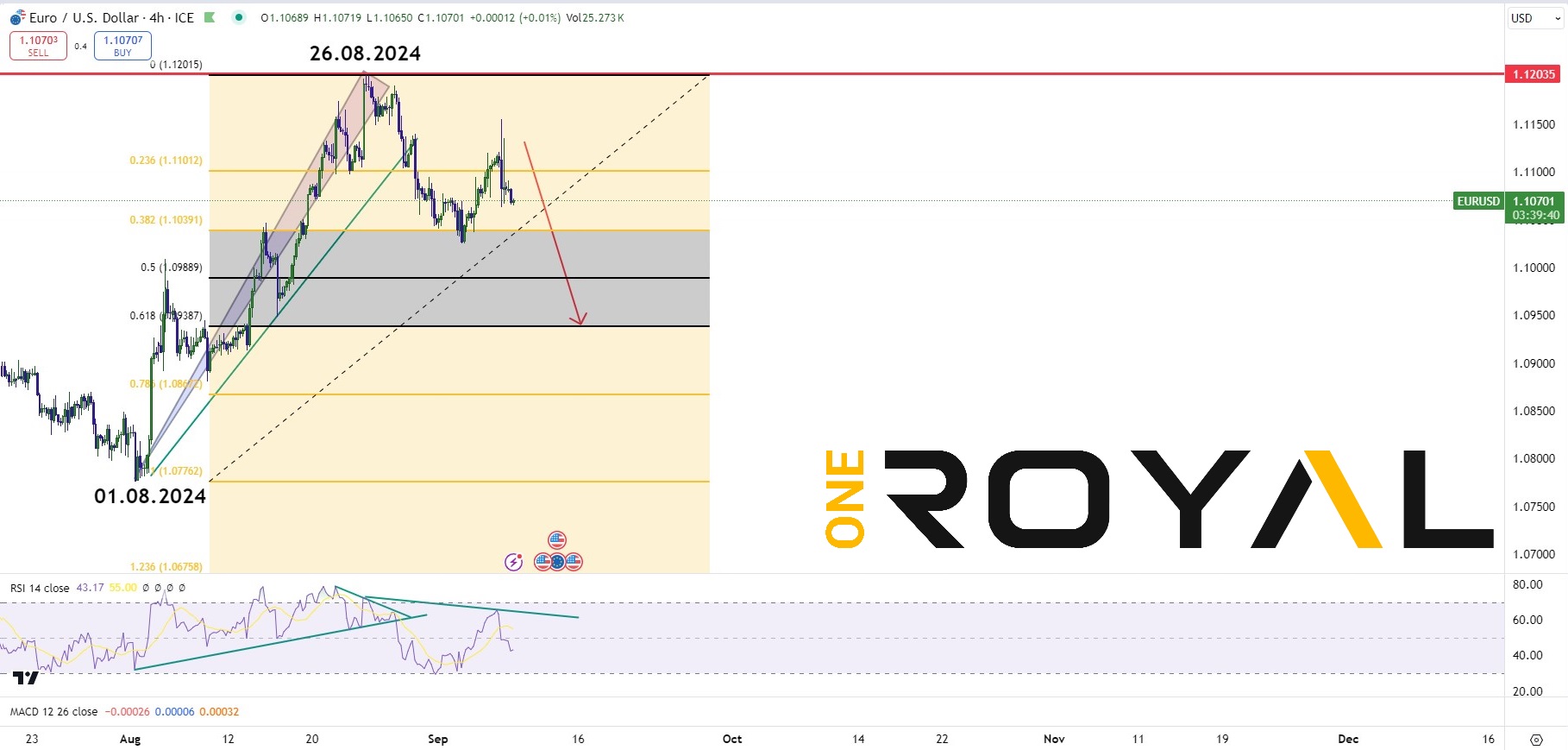

EURUSD – 4 HR As Far As Pivot From 26.08.2024 Remains Intact – Sellers Could Be Targeting Minimum The 1.09500 Area ( 0.618% Fib Retracement From 01.08.2024)

XAUUSD 4HR – As Far As Pivot From 20.08.2024 Remains Intact – Sellers Are Potentially Looking For The 0.5% – 0.618% Retracement From 05.08.2024 Low’s The 2448$ – 2428$ Area

ES500 Mini Futures – 4HR – Cycle From 05.08.2024 Ended – 03.09.2024 Remains Intact – Sideways With A Mixed Outlook Short Term- CPI Will Be Key

In summary, this week traders will need to pay attention to the US CPI on Wednesday the 11th as the market will be looking to price in the outcome. A higher than expected CPI could sent the US Dollar higher in value while US Indices & stock markets such as the SP500, Nasdaq, US30 could react lower. A CPI same as expected or lower could bring the US Dollar value lower and boost the Indices and stocks. The following day’s ECD interest rate cut which analyst expect a 60 basis points cut could weaken the Euro thus creating a reaction lower in the EURUSD. It’s all about the upcoming data and how the markets will trade before and after it. We will be providing updates during the week as the data gets released.

If you are new here and you are not already trading with us you can register you trading account at: https://www.oneroyal.com/en/

Risk Disclaimer: The information provided on this page, including market analysis, forecasts, and opinions, is for informational purposes only and does not constitute investment advice or a recommendation to buy or sell any financial instruments. Investing in financial instruments involves significant risk, including the potential loss of the principal amount invested. Leveraged products, such as CFDs and forex, carry a high level of risk and may not be suitable for all investors. Past performance is not indicative of future results. You should conduct your own research and consult with a qualified financial advisor before making any investment decisions. The firm does not guarantee the accuracy or completeness of the information provided and shall not be liable for any losses or damages arising from reliance on this content. By using this page, you acknowledge and accept these risks.