Chair Powell Speaks Today

Federal Reserve Chairman Jerome Powell will speak today at the Sveriges Riksbank International Symposium on Central Bank Independence in Stockholm, Sweden. Powell’s address comes on the heels of a jobs data on Friday that showed pay growth slowing far more than expected and people working fewer hours for the second month in a row.

The data should encourage the Fed to defer its rate rises even more.

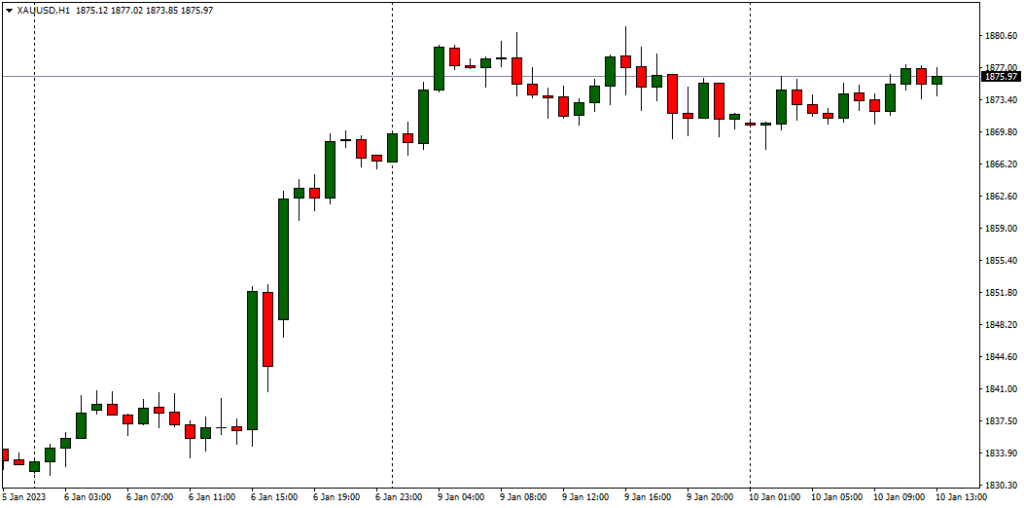

Gold Steadies Ahead of Powell’s Speech and US CPI

Gold prices are steady today, with traders cautiously focusing on Fed Chairman Jerome Powell’s upcoming speech, awaiting any indications that would clarify the path of the US interest rates decision. Gold prices settled in spot transactions at $1875.97 an ounce at the time of writing.

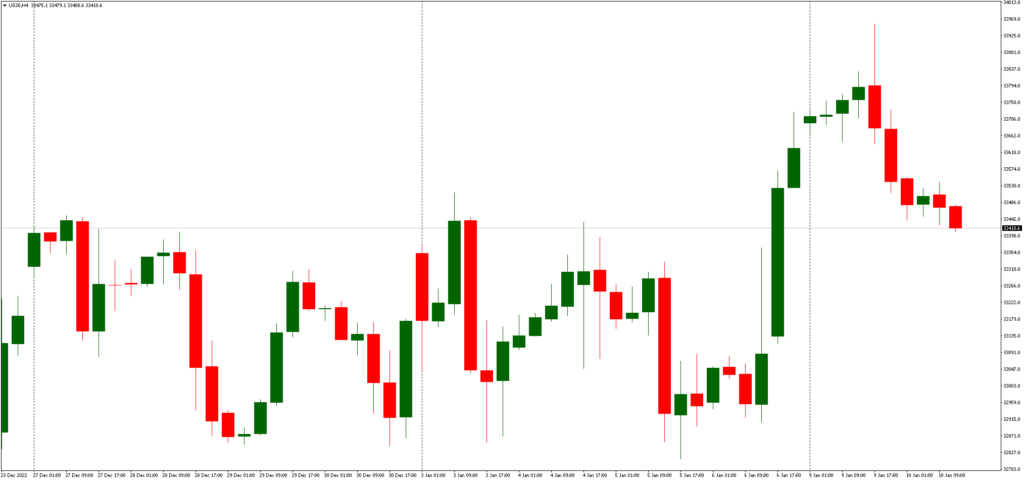

US Indices Lose Monday’s Gains

US indices fell on Tuesday, as investors avoid putting huge bets ahead of Federal Reserve Chair’s speech.

The Dow Jones Industrial Average US30 lost its Monday gains on Tuesday as two Fed members indicated incoming inflation data will help them determine whether to delay the pace of interest rate hikes to a quarter-point increase at a February meeting.

Investors will focus on Powell’s speech later today, along with attention to following the US Consumer Price Index that is said to be released on Thursday for more indications of the Fed’s monetary policy.

Bed Bath & Beyond Stock Spikes following Bankruptcy Warnings

On January 5, 2023, Bed Bath & Beyond warned it might file for bankruptcy and is running out of money. The home-goods giant American classic has assessed the profound uncertainty regarding its ability to continue doing business. BBBY has long been battling declining sales as competition against Amazon, and other rivals increased. Its share price decreased by over 83% in 2022. The company will weigh all available financial alternatives other than bankruptcy, including liquidating assets and restructuring.

Only three days after the announcement, Bed, Bath & Beyond Inc (BBBY.O) shares spiked as retail investors assumed that the company would be a potential for purchase. BBBY is on its way to making its most significant daily gains since August 8. The company’s stock value was up by 35%.

The trading volume of the company’s shares was estimated at $114 million as of mid-Monday, knowing that the total market value of the homeware retailer totals $157 million.

Goldman Sachs Prepares to Layoff 3200 employees.

Goldman Sachs Group will begin laying off thousands of employees nationwide on Wednesday as it braces for more difficult times ahead. It is estimated that 3200 workers would be dismissed. This wave of layoffs would be the worst since the financial crisis in 2008, when 8% of employees were axed.

Goldman Sachs has not officially announced the news, and the banking guru refused to comment. Goldman Sachs and other global bankers have been negatively impacted by a decline in worldwide dealmaking activity, with global investment banking fees declining in half to $77 billion from $132.3 billion in 2021.

Microsoft Aims for More Investments with OpenAi

Microsoft discusses investing in the artificial intelligence company OpenAI, the company behind the ChatGPT chatbot that generates text responses that resemble those of real human beings.

Microsoft’s $10 billion investment would value the San Francisco-based company at $29 billion. Microsoft previously invested $1 billion in 2019 to deploy a version of its search engine “Bing” using the AI behind ChatGPT. The software guru could soon see a return on its $1 billion investment in OpenAI. Microsoft is ready to roll out a version of its Bing search engine soon. The new version of Bing will answer some search queries using the ChatGPT artificial intelligence rather than merely displaying a list of hyperlinks. Before the end of March, Microsoft may roll out the new feature to oust Google, a considerably more powerful competitor in the search market.

Musk Breaks World Record in Wealth Loss

The American Multi-Billionaire Elon Musk is said to be the world’s biggest loser after breaking the record for the most extensive loss of personal fortune ever. According to a Guinness World Record, Musk lost between $183 billion and $200 billion last year, making him the “largest loser of personal fortune in history.”

Musk has taken the title from the Japanese billionaire and the creator of Softbank, Masayoshi Son; the former title holder had been carrying this title since the early 2000s, with losses estimated at $58.6 billion, less than one-third of Musk’s estimated losses.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.