Gold remains close to its lowest level in three months as markets evaluate “Powell’s” statements.

Gold prices have not seen significant changes following the release of new statements by the US Federal Reserve regarding interest rate hikes this year. The yellow metal continues to hover near its lowest level in three months, which was recorded in the previous session.

Gold settled in spot trading at $1928.20 per ounce. US futures contracts for gold declined by 0.22% to $1940.70.

Jerome Powell, the US Federal Reserve’s Chairman, told Congress lawmakers that the expectation of further interest rate hikes is a “perfect guess” for the direction the US Federal Reserve is heading if the economy remains on its current path.

The increase in interest rates reduces the attractiveness of the non-yielding yellow metal.

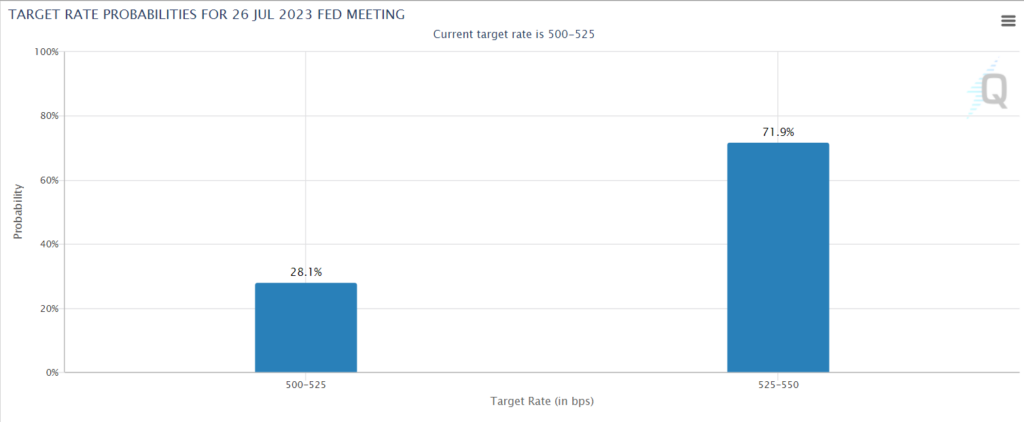

According to CME’s Fed Watch tool, markets expect a 71.9% chance of the US Federal Reserve raising interest rates by 25 basis points next month.

source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The dollar remained stable near the low levels it reached yesterday, Wednesday. Typically, the dollar’s weakness makes gold more attractive to foreign investors.

Market participants are awaiting the US weekly jobless claims data, which will be released at 12:30 GMT. This data is an important indicator of the US economy. They are also anticipating the Bank of England’s decision on interest rates after inflation data came in higher than expected.

As for other precious metals, silver stabilized in spot trading at $22.53 per ounce after hitting its lowest level since March 22 in the previous session.

Platinum declined by 0.53% to $938.00, and palladium lost 1.21% to $1,306.00.

Oil stabilizes after a sudden drop in US crude inventories.

Oil prices held onto most of their gains in early trading on Thursday, June 22, as markets assessed a surprising decline in US crude inventories against weakened demand after the US Federal Reserve Chairman hinted at the possibility of further interest rate hikes.

Brent crude futures declined by 23 cents or 0.3% to $76.89 per barrel, while US crude futures dropped by 18 cents or 0.25% to $72.35.

Both crude benchmarks had risen a dollar per barrel in the previous session as corn and soybean prices in the United States reached their highest levels in several months, leading to expectations that their global shortage would reduce blending with biofuels and increase oil demand.

US crude inventories reportedly fell by around 1.2 million barrels in the week ending June 16, according to sources citing data from the American Petroleum Institute. This came against analysts’ expectations of a 300,000-barrel increase. Official inventory data from the US Energy Information Administration will be released today, Thursday.

Ultimately, higher interest rates result in increased consumer borrowing costs, which may slow economic growth and reduce oil demand.

US Markets experienced consecutive declines amid inflation concerns and stock downgrades.

US markets closed with collective declines on Wednesday, marking the third consecutive daily decline after Federal Reserve Chairman Jerome Powell’s testimony before Congress reinforced the central bank’s goal of curbing inflation, again hinting at the possibility of interest rate hikes.

Financial markets priced in a 71.9% probability of a 25 basis point interest rate hike at the upcoming policy meeting in July.

- US30: The Dow Jones Industrial Average declined by approximately 0.3%, or around 100 points, in Wednesday’s session, bringing the total decline to 1.3% over the last three sessions.

- S&P500: The S&P 500 index decreased by around 0.5%, while the Nasdaq Composite index fell by 1.2%, marking its largest daily loss in two weeks.

- Tesla stock: Tesla shares dropped by around 5.5%, recording the biggest daily loss in two months during Wednesday’s session. The stock retreated from its nine-month high after surging by approximately 120% since the beginning of the current year.

- FedEx stock: FedEx shares declined by 2.5%, marking the third consecutive session of losses and resulting in a $1.5 billion decline in the company’s market capitalization in a single session. These losses followed FedEx’s disappointing quarterly profits and the announcement that the global demand decline is putting pressure on its profit margins.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.