Apple shares drop $27B in 2 sessions, Coinbase sees biggest daily loss in 2 months.

The US indices closed with collective gains in Tuesday’s session amid investors’ anticipation of inflation data and the Federal Reserve’s decision next week.

It is expected that inflation data will show a slight decrease in consumer prices on a monthly basis in May. Still, core prices are likely to remain high, and the Federal Reserve is widely expected to keep interest rates unchanged.

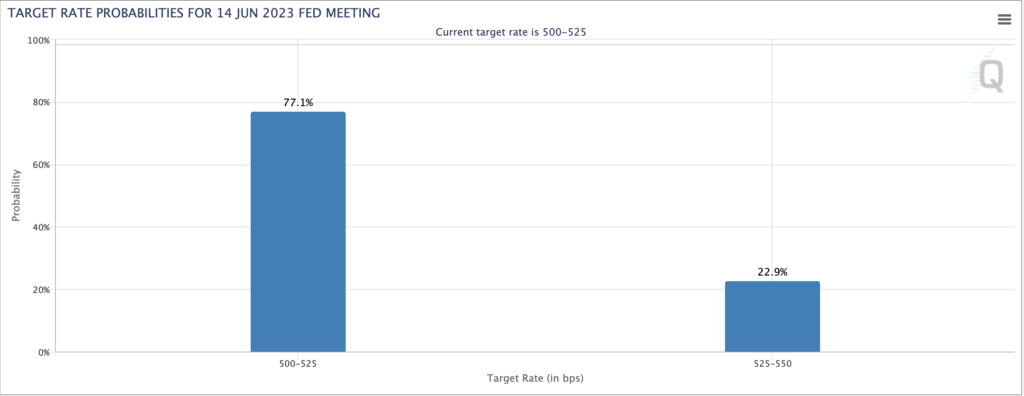

Data from Fedwatch indicates that the probability of a 25 basis point interest rate hike reached around 22.9%, compared to 77.1% for keeping them unchanged.

Source: https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

The Dow Jones index closed higher by about 10 points on Tuesday after recovering all its losses by the end of the session, having touched the 50-day moving average levels in the early hours of the session.

The S&P 500 index rose by about 0.2% to remain at its highest levels in 9 months.

The Nasdaq Composite index also increased by about 0.4% to its highest level since April 2022.

- Apple Stocks:

Apple shares closed down by 0.2%, marking a second consecutive decline following the company’s announcement of its latest products at its annual Worldwide Developers Conference.

During the two sessions, the world’s most valuable company lost approximately $27 billion in market value, bringing its market capitalization to around $2.818 trillion.

Apple’s shares dropped from their all-time highs after the company unveiled its mixed reality glasses, Vision Pro, as its first significant new product since 2014, priced at $3,499.

- Coinbase Stocks:

Coinbase shares plummeted by around 12% in Tuesday’s session, recording the largest daily loss in over two months after the US Securities and Exchange Commission (SEC) filed a lawsuit against the digital currency exchange, accusing it of operating unlawfully without first registering with the regulatory agency.

Nikkei index posts biggest drop in 12 weeks after consecutive gains.

The Nikkei index dropped by 1.82% to close at 31,913.74 points, marking the largest daily decline since March 14th and ending a four-day winning streak.

The index had initially risen by 0.6% in early trading, following the overnight gains on Wall Street, where it had reached its highest level since July 1990 in the previous session.

The broader Topix index also declined by 1.34% to 2,206.30 points.

Among the stocks listed on the Nikkei index, 26 rose, and 197 declined, while two remained unchanged.

European stocks declined, while Spanish stocks performed strongly.

Spanish stocks rose on Wednesday, June 7th, after Inditex, the owner of the Zara brand, announced strong quarterly results. In contrast, other European stock markets fell following losses in luxury goods and mining companies’ shares due to weak trade data from China.

The European Stoxx 600 index declined by 0.2%, while the Spanish index increased by 0.6%.

Inditex shares rose by approximately 4% after the company reported a 16% jump in sales for its spring and summer collection over the past month.

The European retail sector index surged by 2.2%, driving gains in the subsectors, while the mining sector declined by 0.7%.

Disclaimer: This article is not investment advice or an investment recommendation and should not be considered as such. The information above is not an invitation to trade and it does not guarantee or predict future performance. The investor is solely responsible for the risk of their decisions. The analysis and commentary presented do not include any consideration of your personal investment objectives, financial circumstances, or needs.